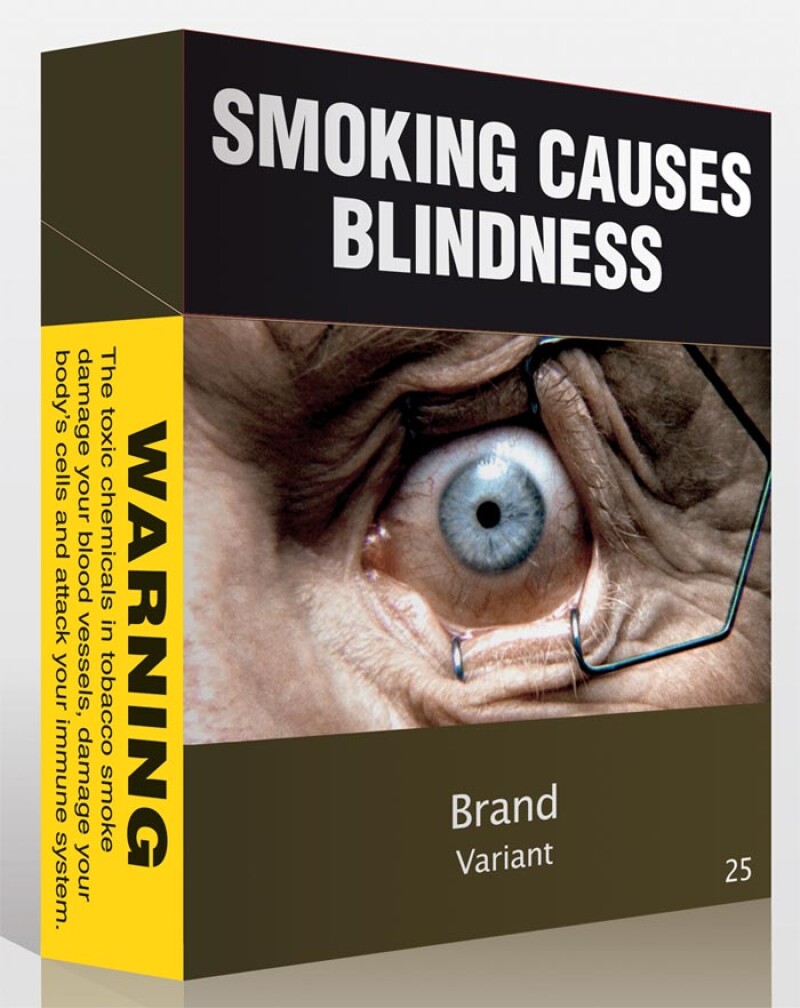

Last week, British American Tobacco Australia (BAT) spokesperson Scott McIntyre released a statement declaring the world’s first tobacco plain packaging law a failure. McIntyre said that the law has had no effect on legal tobacco sales and is driving an increase in demand for illegal products.

|

This argument comes from a report by KPMG which was commissioned by BAT, Philip Morris and Imperial Tobacco Australia about plain packaging. Defining the illicit market as unbranded tobacco, contraband (otherwise legal products where duties have not been paid) and counterfeits, it found that there was an 8.2% increase in the size of the illicit market in the 12 months up to June 2013 when compared to the whole of 2012. It also found that tobacco consumption overall did not drop at an increased rate after the plain packs law came into effect.

Easy to fake it?

The law’s opponents have seized upon this report as evidence that plain packaging has not achieved its goals of reducing smoking, and that the increased in illicit tobacco has resulted in lost revenue for the government. The proponents of the law, such as Cancer Council Victoria, have challenged the KPMG report’s finding on both the efficacy of plain packaging and the claim that the illegal market has increased in size.

Of particular interest to trade mark practitioners is the debate over the counterfeit market. Opponents of plain packaging have long argued that plain packaging requirements make it easier for counterfeiters to sneak fakes into the market.

The KPMG report is one of the first studies with data about the counterfeit market in the plain packaging era, though the admittedly new evidence doesn’t show much to support the counterfeiting argument. Using a survey of empty tobacco packs collected in public trashcans throughout Australia, it found that the consumption of counterfeit manufactured cigarettes increased 70% between 2012 and the 12 months leading up to June 2013, though it also notes that the compound annual growth rate for counterfeit tobacco has dropped 4.4% from 2009 to June 2013. Furthermore, it shows several similar increases and decreases during this time frame.

In short, this increase in counterfeits looks more like statistical noise and less like an inflection point.

Seizure information from Australian Customs shows an increase of seizures of manufactured cigarettes in sea cargo, though again this increase is part of a five-year trend. In its 2012-2013 operation year, Customs seized 200 million sticks of manufactured cigarettes, a total that includes both counterfeits and contraband. This is an increase over the 141 million seized in 2011-2012, and the 82 million in 2010-2011. Data going back five years shows a drop each year, and is thus similarly inconclusive about the effects of plain packaging.

A spokesperson from Customs also told Managing IP that plain packaging doesn’t appear to have a big effect on smuggling, though she also points out that Customs’ priority is with the evasion of duty rather than counterfeiting per se. She explains that since plain packaging came into effect, there have been numerous seizures, only one of which involved plain packs.

Worried about counterfeits?

Furthermore, tobacco companies themselves are not using Customs to fight counterfeits. Though Australia has a Customs recordal system for IP owners, the Customs spokesperson notes that only one of the three major tobacco brands (BAT, Philip Morris and Imperial) have lodged a notice of objection. Customs can only seize counterfeit goods when the brand owner has filed the notice of objection.

Though debate about the effect of the law on brand owners and smokers’ habits will rage on, the data does not appear to support the claim that that plain packs have made counterfeiters’ jobs easier.