This week, negotiators from the EU and the US are convening in Brussels for the second round of talks on the Transatlantic Trade and Investment Partnership (TTIP). The broad-based trade agreement, which purports to further lower trade barriers and streamline bureaucratic red tape between the EU and US, will also likely contain IP-related provisions.

The European Commission is already anticipating resistance, or at the very least scepticism, about the deal. In this Q&A for example, the Commission attempts to assuage concerns about any IP provisions, stating that the TTIP is not a “back door” attempt at reinstating the Anti-Counterfeiting Trade Agreement (ACTA), the controversial treaty that was derailed after sparking protests in the streets of Europe.

However, critics are also pointing to wider concerns. Last week in The Guardian, George Monbiot took to task the treaty’s investor-state dispute resolution mechanisms, which allow private parties (investors) to bring countries to arbitration for violations of the agreement. Monbiot argued that the dispute provisions were anti-democratic because they “allow a secretive panel of corporate lawyers to overrule the will of parliament and destroy our legal protections”.

Interestingly, he points to two IP-related disputes as examples of rights holders using investor-state dispute provisions in an attempt to reshape laws in their favour. One is a matter brought by Eli Lilly under the North American Free Trade Agreement, after Canadian courts invalidated the patents for Straterra and Zyprexa. The US-based drug company alleges that the invalidation violated NAFTA’s protections against the expropriation of investors’ property. The second case involves Philip Morris’s challenge to Australia’s tobacco plain packaging laws under a Hong Kong-Australia bilateral trade deal after the Australian Supreme Court upheld the law.

Investor-state dispute clauses are now part of many bilateral agreements, and Monbiot is not the only one critical of them. Hafiz Aziz ur Rehman of Médecins Sans Frontières' Access Campaign told Managing IP that he is concerned that developing countries may have trouble marshalling the resources to defend itself in these cases. Furthermore, he argued that compared to the state-to-state dispute resolution procedures before the WTO, investor-state dispute mechanisms lack transparency and are generally less clear.

The EC has attempted to address these claims about the investor-state dispute provisions, explaining for example the various mechanisms designed to eliminate conflict of interest claims among those deciding the disputes.

|

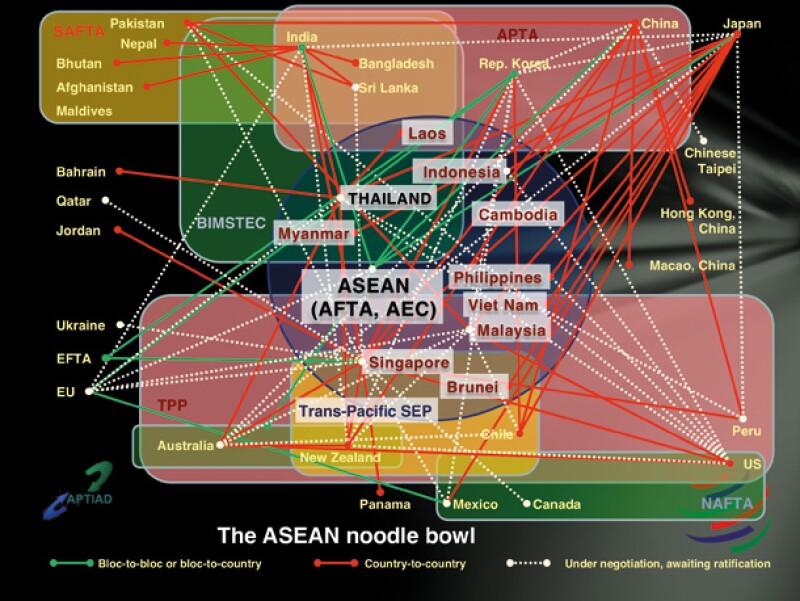

Not the good kind of noodle |

Beyond these concerns, the inclusion of investor-state settlement provisions in most bilateral agreements, and the growing popularity of such agreements, may be an impediment to harmonisation and progress. The growth of bilateralism at the expense of multilateral treaties such as TRIPS is already leading to a patchwork of IP standards.

Furthermore, each bilateral agreement almost invariably contains its own investor-state dispute resolution, potentially giving any party another bite at the proverbial apple beyond the avenues provided by the national courts and the WTO. In the plain packaging dispute, opponents already have three venues to attack the law; in addition to the string of cases before the Australian courts, Philip Morris also has its case under the Hong Kong-Australian trade agreement. Furthermore, a number of countries, five by the last count, are challenging the law before the WTO armed with legal support from the tobacco companies themselves.

Rights holders obviously need avenues to protect and vindicate their rights, but given the push for more and more FTAs and bilateral treaties, the venues available to challenge any new legislation will only increase. While some rights holders may welcome having so many chances to strike down unfavourable legislation, this tangle of agreements may eventually become a quagmire that drags down any attempt at legislative change, even ones that further harmonisation.