|

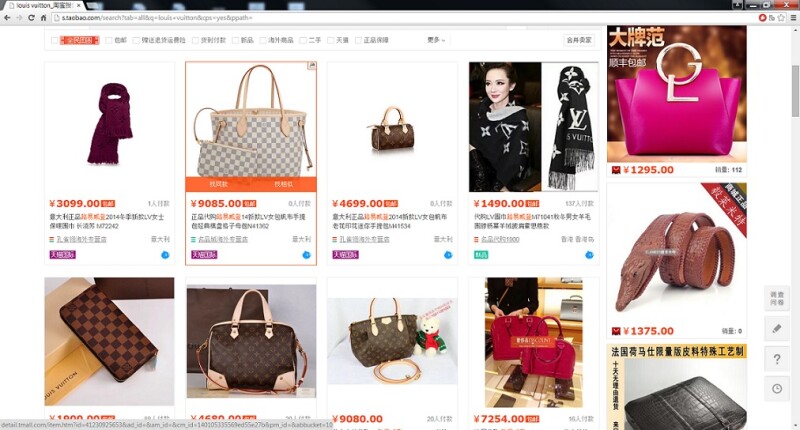

Alibaba's Taobao, China's largest ecommerce site, features many products with luxury branding |

On Wednesday, China's State Administration for Industry and Commerce (SAIC) released a white paper slamming Alibaba for a range of illegal practices relating to its online marketplaces.

The paper faulted the company for not taking sufficient steps to stop the sale of counterfeit goods on its platforms, including Taobao, its tremendously popular eBay-like shopping platform. The paper also accused the company of other misdeeds, including failing to ensure that sellers have appropriate registrations and licences, engaging in anti-competitive practices and not doing enough to clamp down on misleading seller practices such as fake transactions and reviews to boost rankings.

In response, Alibaba acknowledged that it needed to do more to combat problems. However, it also said that it disagreed with the findings and that it would file a complaint with the SAIC over what it claims to be procedural misconduct in the investigation.

A persistent problem

Criticisms of Alibaba from rights holders and international governments are nothing new. Taobao was listed as a notorious market by the United States Trade Representative until 2012, and even after it was taken off the list, the presence of counterfeits on the platform persisted. Since then, Alibaba has continued to work to improve its anti-counterfeiting efforts, including agreements to cooperate with brand owners such as Louis Vuitton Moet Hennessy, Microsoft and Keiring (the owner of brands including Gucci). The company has also continued to refine its takedown procedures, including the most recent changes to the TaoProtect system. Yet, despite some newsworthy gains and high-profile agreements to work with groups such as the China-Britain Business Council, representatives from several international companies have told Managing IP of their continuing dissatisfaction with Alibaba's efforts at protecting brands.

Not just about counterfeits

Though reports on the SAIC's criticisms have focused largely on the counterfeiting issues (and possibly implications for Alibaba's record-setting IPO), there is indication that government concern about counterfeiting is just one small part of a bigger push to assert greater regulatory control over online commerce. As previously mentioned, the SAIC white paper pointed to several non-IP problems it had with Alibaba's platforms. In fact, one of the leading complaints in the white paper related to the persistence of unregistered and unlicensed enterprises selling on Alibaba's marketplaces, as well as businesses using fake names and engaging in unauthorised activities. These concerns implicate not just the government's ability to protect intellectual property but also its broader interests in regulating e-commerce.

"These issues concern matters such as taxation, control, awareness of who the sellers are, and traceability," says one Beijing-based observer.

The white paper may be considered another step in the government's attempts to impose stronger e-commerce regulations. In March, the SAIC implemented its "New Measures for the Administration of Online Trading", which sought to increase consumer protections. In October, the SAIC and the Ministry of Industry and Information Technology issued its "Opinions on Reinforcing Collaboration on Supervision of Domestic Online Trading Websites and Active Promotion of the Development of E-Commerce", which further highlighted the need to regulate the e-commerce space. And earlier this month, China Daily reported that the National People's Congress will be submitting a draft of the country's first e-commerce law soon.

A good sign?

Though businesses are often sceptical of increasing government regulation especially on the famously freewheeling internet, the upcoming changes may actually be welcomed by brand owners. Some of the problems that hamper online enforcement, such as the difficulty in tracking infringers and the relative ease with which sellers can take on new online identities, may be addressed in this move, even if the expected changes do not necessarily prioritise IP enforcement. Though much will depend on the details of any new law and regulation that comes out, as well as the actual implementation, Alibaba's troubles may potentially be a boon for brand enforcement.