Last month, regulators at China's State Administration for Industry and Commerce (SAIC) publicly called out tech company Alibaba for alleged illegal practices taking place on its enormously popular online marketplaces. Though the SAIC's white paper contains a range of allegations including the proliferation of false reviews and sales, improperly registered businesses and anti-competitive behaviour, it was the claim of rampant counterfeiting that has been getting the most attention.

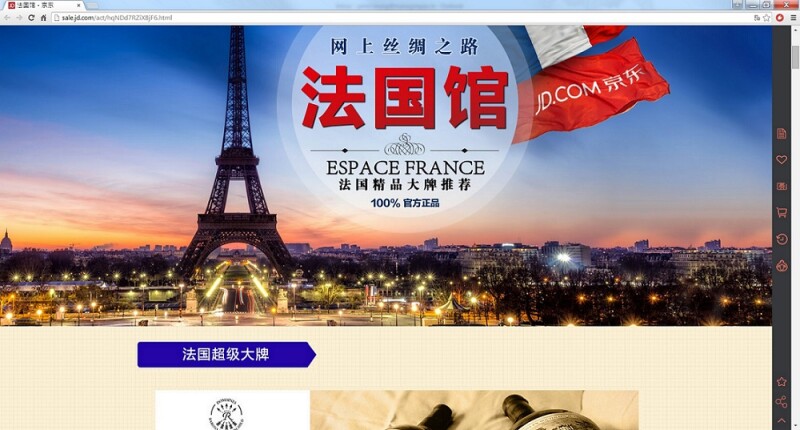

Alibaba's (much smaller) competitor JD.com also weighed in on the counterfeiting issue. Last week, JD launched the French Mall, which promises to carry only genuinely imported French products. Though JD's statement does not refer to Alibaba or its Taobao market, its timing is at the very least serendipitous.

JD clearly believes that Chinese consumers increasingly value having at least some types of non-infringing goods. Much has been made of the growth of China's middle class and its demand for name-brand goods, and the company's initiative seems to be betting that catering to those needs will be a profitable venture that can help it catch up to the market-leading Alibaba. In other words, while Alibaba has in the past been accused of letting fakes proliferate because it makes money on each sale, a charge that it has denied, the French Mall is JD's bet in the opposite direction.

It remains to be seen whether JD's new focus on authentic goods will be successful, but for rights holders, this is an encouraging sign. Chinese officials and academics have long argued that China's IP system will develop as its economy grows, essentially, when it is in its economic interest to have stronger IP protections. Baroness Neville-Rolfe, the UK's IP Minister, similarly expressed confidence of an improving IP environment in China when she said that China has "skin in the game" as its businesses increasingly rely on intellectual property.

There is some support for this logic. As Kevyn Kennedy of CBI Consulting explained to Managing IP, counterfeit leather goods were once very common in Taiwan, especially those sold by street vendors. But as consumers grew more prosperous and more sophisticated, the demand for knockoffs dropped. Similarly, Hong Kong is often held up as a place where counterfeiting has been significantly curtailed. In that case, evolving market behaviours may also have played a role - a 2013 study showed that social stigma is one of the biggest reasons to not buy counterfeit luxury goods. In fact, tourism from the mainland to Hong Kong is driven in part by the perception that it is a reliable (and cheaper) place to get genuine goods, whether it be watches, luxury clothes or even baby formula.

What do you think? Is JD.com's French Mall a sign of increasing demand for genuine goods in China?