Chinese companies employ a wide variety of approaches when managing their intellectual property abroad, but there are some common themes. The most notable is a belief in the importance of preparation; in-house counsel all spoke of caution and diligence when preparing to enter new markets. This focus on anticipating problems and avoiding needless litigation is partnered with a strong sense of business goals, and how IP strategic decisions must serve to advance those goals.

Home is where the staff is

Whether a Chinese company is exploring overseas expansion or has already made the move, it tends to keep most of its IP legal work in China. Kong Xiangsheng, the director of the IP department at Livzon Pharmaceutical, a Shanghai and Hong Kong-listed company based in Guangdong, explains that while it sells its products in the US and has had patents granted there, all the in-house IP work is done in China.

"We have about 20 employees in the US and Europe, and another 60 in Hong Kong, mostly in sales and marketing," explains Kong. "It is too expensive to have our IP staff in those places, and I don't see a lot of value in it. If I have a matter in the US or UK, I can contact the outside counsel myself."

Livzon has a lot of confidence in its IP team in China, which may be another reason why it prefers to keep its work there. Kong says that a number of the attorneys on his team worked within China's State Intellectual Property Office (SIPO), and they are very knowledgeable about the company's core technologies. This team will then liaise with outside foreign attorneys for projects such as international patent filings.

Shanghai CP Guojian, a pharmaceutical company that specialises in producing antibiotics, also relies on a China-based IP staff. All of the company's 600 employees are located in China.

But while it is unsurprising that relatively small Chinese companies keep their IP expertise in China even as they begin to take their products overseas, that is beginning to change, say foreign attorneys.

"Right now some companies are too small to have legal staff here in Europe, but sooner or later they will want to start a subsidiary," says Otto Oudshoorn of Vereenigde, who does a lot of work with Chinese companies. "We have had IP clients who have asked us to help them set up a presence in the Netherlands, or elsewhere in Europe."

These companies are likely to begin to emulate two of China's biggest and best-known businesses: Huawei and ZTE, who are developing important in-house IP capacity in their overseas operations.

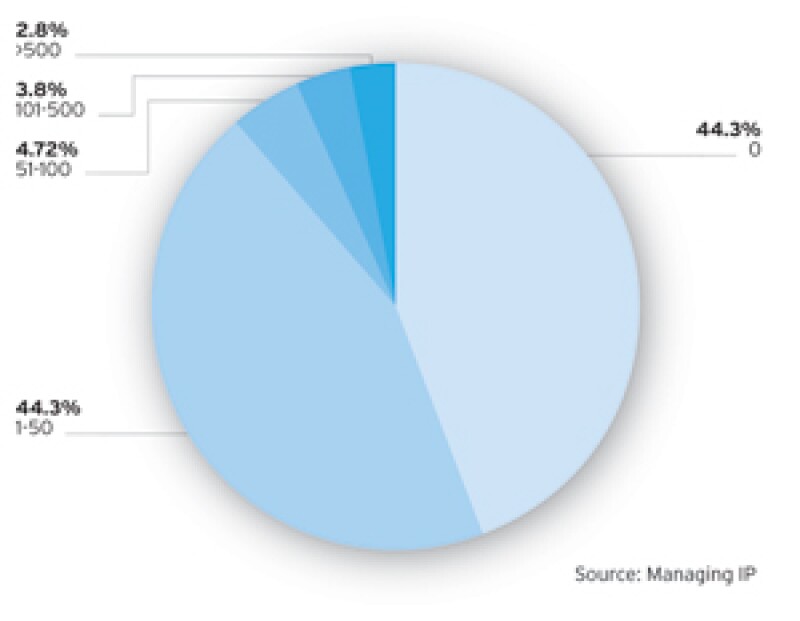

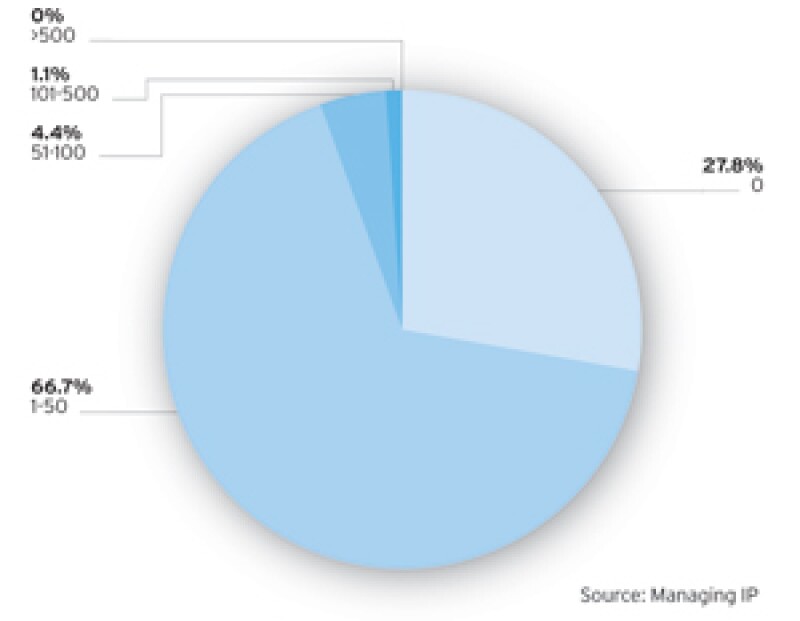

Figure 1: How many patents have you registered overseas? |

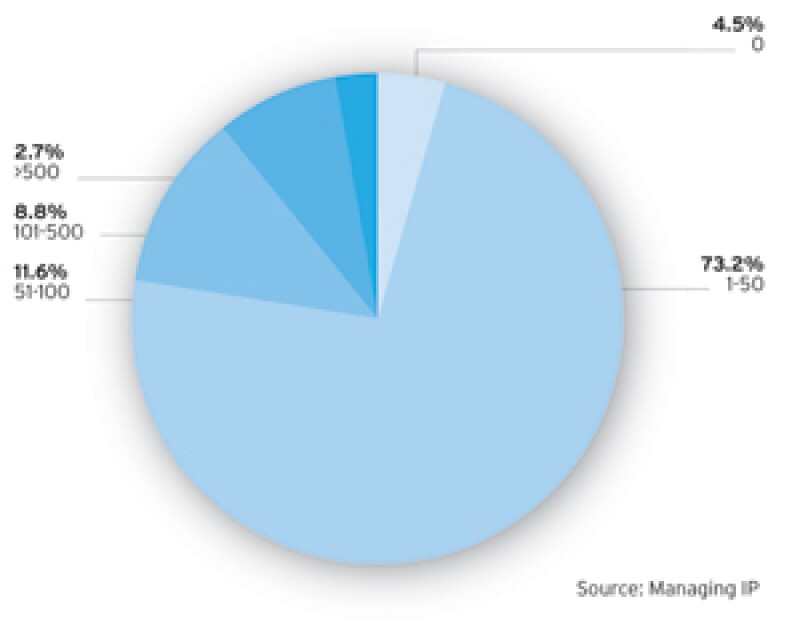

Figure 2: How many more patents will you register overseas over the next 12 months? |

|

|

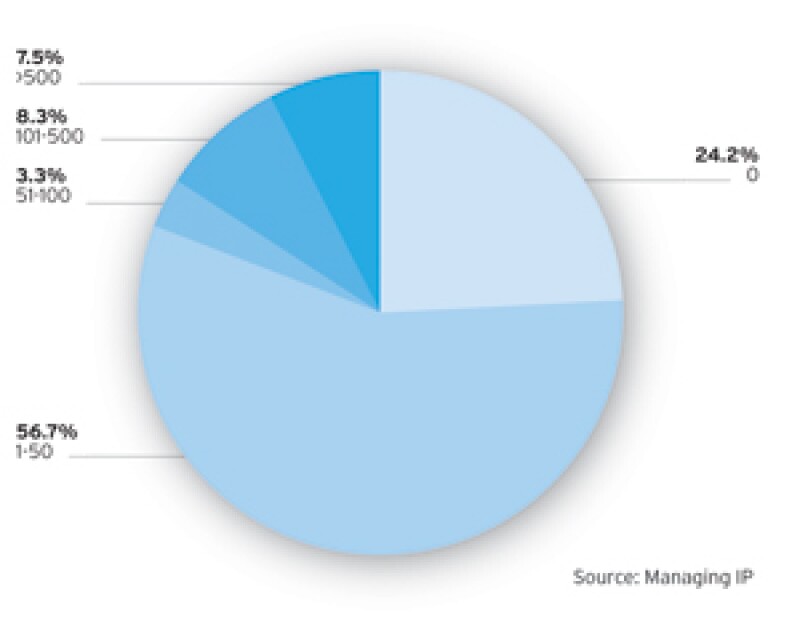

Figure 3: How many trade marks have you registered overseas? |

Figure 4: How many more trade marks will you register overseas over the next 12 months? |

|

|

Doing their research

If there is one thing that outward-looking Chinese companies have in common, it is a certain diligence about investigating IP in each target market before they commit to expansion. Each of the in-house counsel who spoke with Managing IP emphasised the need to anticipate problems and minimise the potential for costly legal battles whenever they can.

Before entering new markets, ZTE for example looks closely at two factors: the strength of potential competitors' IP portfolios and the level of protection in each market, says Alvin Shen, director of the company's IP department. His team categorises each market as low, medium or high risk. From there, Shen and his team will examine the market opportunities and risks, and how this fits in with ZTE's own patent portfolio.

Shanghai CP Guojian has a similar approach to expansion. Li Caihui, chief IP officer for the company, says that despite the fact that Shanghai CP has grown rapidly in the last few years, its approach to international markets is very deliberate.

"Right now, our only international market is Colombia, though we have been looking into other markets, including India, Thailand and the United States," she explains.

Shanghai CP Guojian's IP exploratory work is done by the internal IP team based at the company's Shanghai headquarters, Li explains, relying largely on the Dialog patent search database to find related patents that might cover its products in other countries.

The careful planning has paid off so far. Li says Shanghai CP Guojian has not been involved in any IP disputes abroad, unlike some of its peers.

This prudence is consistent with Oudshoorn's experiences with Chinese clients: "I don't think they are very litigious. They seem to be building their portfolios defensively to decrease the risk of unpleasant situations, such as getting sued."

Figure 5: What IP transactions has your company taken part in? |

|

Transactions |

Responses |

Obtaining a licence to a foreign company’s patents |

20 |

Obtaining a licence to a domestic company’s patents |

34 |

Obtaining a licence to a foreign company’s trade marks |

4 |

Obtaining a licence to a domestic company’s trade marks |

8 |

Granting a licence to a foreign company to use your patents |

15 |

Granting a licence to a domestic company to use your patents |

33 |

Granting a licence to a foreign company to use your trade marks |

6 |

Granting a licence to a domestic company to use your trade marks |

13 |

Buying a patent at an auction |

6 |

Buying a trade mark at an auction |

1 |

Selling a patent at an auction |

7 |

Selling a trade mark at an auction |

2 |

Other |

2 |

None |

48 |

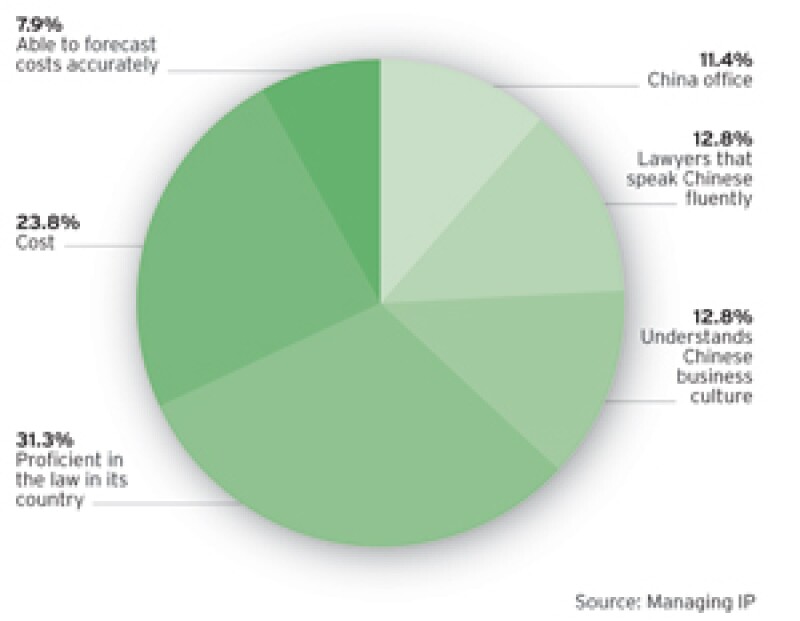

Figure 6: What factors are most important when assessing foreign law firms? |

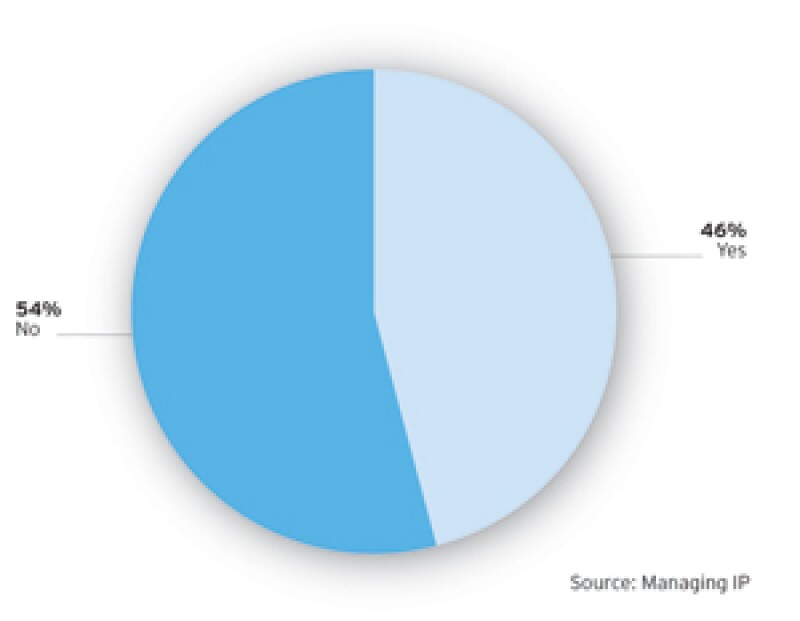

Figure 7: Has your company received local or national grants to help with filing patents overseas? |

|

|

The gloves come off

Although many Chinese companies understand the importance of gathering intelligence about new markets, some also see the need for aggressive action when problems arise. During its pre-entry research on the IP landscape in the US, Alex An, CEO of JK Sucralose, a Jiangsu-based sweetener manufacturer, realised that his company would likely face patent challenges. One potential source of conflict was its UK-based competitor Tate & Lyle, maker of the sweetener Splenda.

The US market was an important part of JK's business expansion plans, and An decided that the cost of litigation was ultimately worth the risk. In preparation for entry into the market, JK's legal team quietly laid down the groundwork for a court battle with an eye to the company's overall business strategy. As expected, JK was forced to intervene in an ITC 337 action against Tate, which tried to bar Chinese sucralose manufacturers from entering the US on patent infringement grounds. JK prevailed (see case study), becoming the first Chinese company to intervene in and defend an ITC action successfully.

"If you want to sell in the US market, then you should realise that IP litigation is a weapon for you to use, and you should think about how to use litigation to help you to get the market," An advises. "You need to think about litigation strategy and market development strategy together."

Increasing sophistication

JK's success at the ITC may be a sign of an increasing willingness to engage in more complex legal actions. Chinese companies have long had a reputation of being very cost conscious, but some are beginning to see the value of high-quality legal representation.

For JK, it was important that his law firm understood that companies don't go to court without business goals in mind. An, who spoke with a number of US law firms before engaging Fish & Richardson, says that its attorneys understood how the lawsuit related to JK's business plans. Furthermore, he stresses the importance of communication and trust (qualities aided by the fact that he is friends with an attorney at Fish). Even though An was aware that litigation is expensive, he decided to hire Fish in part because it allowed JK to pay the total amount of fees at the end of the case.

Private practice attorneys also see this change in attitude among more sophisticated Chinese companies.

"I think clients are getting more comfortable with the cost of legal services," says Michael Shu, senior partner at the Shanghai office of Beijing-based law firm Wan Hui Da. "Chinese firms are very cost conscious, but after shopping around for a while, they realise that a cost they consider high is the market price. They are beginning to learn that while there are some firms that are cheap, they are not always the best or the most thorough."

Managing the portfolio

The caution that Chinese companies show when entering new markets extends to their IP management strategies. The companies Managing IP spoke with each have their own approach to how they develop their portfolios for international markets, but the one common theme is that the company's overall business goals are always central to their plans.

Alvin Shen says that it is important for companies to be strategic and develop their international patent portfolios wisely. Even a large company such as ZTE does not have unlimited funds, so it picks only its strongest technologies to develop internationally. He says that as the company has expanded abroad, potential customers will evaluate its capabilities by the strength of its patent portfolio so it is important to show that the company is capable of handling complex technical problems.

ZTE's pre-entry research also informs its portfolio management decisions. In markets where it sees potential IP problems, Shen says that it will try to enter into licensing agreements with competitors to defuse the risk. The company uses this combination of its own technologies and licensing agreements to reduce its IP risk and to build its presence in new markets.

Licensing is also a popular option among Chinese companies. Over half of the respondents to Managing IP's survey said that they have been involved in IP transactions, many with foreign companies. Of the 66 respondents who said they have experience with IP transactions, more than half were party to a patent licensing deal with a foreign company, and another 10 were involved in trade mark licensing (see figure 5).

Livzon's IP management strategies are similarly varied and tailored to the market in each country. Kong said that while Livzon initially focused on medicines based on traditional Chinese remedies, in 2002 it shifted toward biomedical technology, which made IP management much more important. The company has filed a few patents in large jurisdictions such as the US, but is also interested in buying and licensing technologies from others. Korea is one market where the company has bought and licensed technology from others.

Kong also picks out a number of factors in the decision to license from others or develop its own technology: "It depends on the particular market. We also need to look at how long the research and development will take. If it takes too long to start up the technology ourselves, we might try to license the technology from someone else."

Livzon has also allowed European companies to use some of its technologies, but it is extremely careful when doing so. "We examine the capabilities of the European company, and in the agreement we may include certain requirements, such as sales targets," Kong explains. "We are also very cautious, and the agreements are often very short, perhaps just for a year."

Shanghai CP Guojian's portfolio management strategy reflects its cautious approach. Li says that it has a few international filings and has a patent in Europe, the US and Japan. While it does not extensively patent its technology abroad, the company is very concerned about technology leakage, one of the reasons why it keeps all its manufacturing in China. It also uses its agreements with foreign partners to protect its intellectual property.

JK Sucralose also relies on its trade secrets and Chinese-based manufacturing to protect its IP. An notes that the company has patents in the US, Europe and Japan, but does business in a number of other markets. He explains: "All our production is done in China and we are good at keeping our trade secrets under control, so we are not too worried about infringement of our intellectual property even in places where we do not have patents."

Chinese companies' IP management strategies are becoming more sophisticated, which increases the need for outside counsel. So what do Chinese companies look for when hiring attorneys?

Choosing advisers

The need to engage in complex IP work makes picking the right counsel more important than ever. Some companies such as JK value working with known and trusted advisers. Others, like Livzon and ZTE, will try out different law firms with different tasks.

Kong says that Livzon has a stable relationship with a handful of firms, categorised by cost and quality, as well as practice area specialties. He says that while his company is willing to try out new firms, he will give them smaller projects to test them out. For more important matters, he uses larger firms. For example, Livzon has hired established firms like Mintz Levin to handle its patent filings in the US, a country where it patents only its strongest technologies.

ZTE is also willing to try different firms, and maintains a detailed database of law firms. It keeps information on the work each firm has done, and has an internal evaluation system to help choose among the firms.

Chinese companies also put particular value on attorneys who understand their overall strategy and act as an external team member, rather than a billing machine. Cindy Bian, in-house counsel for Huawei, said that she had previously engaged lawyers who would send invoices after five-minute calls for advice.

An has this advice for foreign lawyers seeking outbound Chinese clients: "Talk directly to the decision makers in the company, and learn about the company's plans in the next five or 10 years. Law firms need to know how their work fits into the company's business goals, because we don't enter lawsuits for the sake of having lawsuits."

Making the push

Armed with increasing budgets and experienced legal advisers, many expect Chinese companies to continue their rapid expansion abroad. Seventy-six per cent of respondents to Managing IP's survey said that they already have at least one registered patent abroad and 16% have over a 100. Nearly half said they have received grants from a Chinese government agency to file an overseas patent (figures 1 and 7).

Chinese companies are also beginning to adopt aggressive litigation strategies to defend their IP and advance their own businesses. JK Sucralose, for example, is the plaintiff in a patent infringement suit in Japan against a Tate & Lyle distributor. Livzon has been involved in lawsuits in Europe defending patents relating to treatments for bird flu.

Some lawyers anticipate more sophisticated IP-related deals in the near future. Cecilia Lou of King & Wood Mallesons thinks that deals where IP serves as capital may become more common. And that trend is not confined to patents. Her colleague Mark Schaub says he expects Chinese companies to become very acquisitive, highlighting foreign luxury brands as potential targets. Traditional British brands such as Aquascutum, Gieves & Hawkes and Hardy Amies have all been bought in recent years.

Defying expectations

Despite China's reputation as a country where attitudes toward IP are cavalier at best, the companies looking overseas have adopted deliberate and careful approaches to managing intellectual property. This caution shows an understanding of the importance of IP and of the costs of litigation. The change will come when more companies grow to the size of a ZTE or Huawei, and start setting up IP offices in foreign countries as well as their lawyers.