The article below is third party content and does not necessarily reflect the views of Managing IP

Since the publication of the article on 5G SEP leadership in October 2020, the 5G industry has gone from strength to strength. However, while 5G coverage and data speeds continue to improve, publications on 5G patent leadership continue to suffer from a lack of rigour and transparency.

Confusion as to which companies have the strongest 5G patent portfolios may create inefficiencies in the market and harm the incentive for patent holders to continue to innovate, for example, because it disrupts the ability for patent holders to license their patents, and licensing is the primary method that such companies are able to share the rewards of 5G’s success. This article is intended to provide some much-needed clarity to the question of 5G patent leadership.

5G is a standardised technology, and patents which read onto the 5G standard are called ‘standard essential patents’ (SEPs). Companies which participate in the standard development process agree to license their SEPs on fair, reasonable and non-discriminatory (FRAND) terms. Participants to standard-development activities declare patents which ‘may be’ or ‘may become’ SEPs to standard bodies such as the European Telecommunications Standards Institute (ETSI). This means that not every patent declared to the 5G standard is truly a SEP, a phenomenon often referred to as ‘over-declaration’.

5G landscaping reports are contradictory and lack transparency

Given the commercial importance of 5G, it is not surprising that there are regular attempts by consultancy and analyst firms to assess which companies have the most 5G patents. Since the publication of the last article on this topic, industry commentators have started to express increased scepticism in the results of 5G landscaping reports due to a continuing lack of agreement between the various studies.

However, increased scepticism has not resulted in greater clarity, as new reports continue to show contradictory results. The debate as to 5G leadership is also a geopolitical one, and the opinion that China is leading the 5G race, popularised by mainstream media, risks inflaming a potential China-Western trade war.

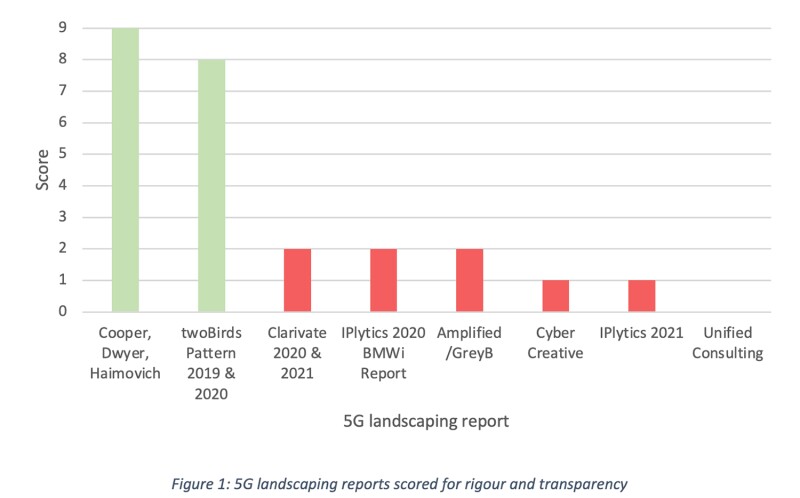

While the quality of 5G landscaping reports varies, flaws as to rigour and/or transparency are not always immediately obvious to the reader. Therefore, to provide some much-needed clarity to the question of 5G patent leadership, eight different 5G landscaping reports have been reviewed and scored for rigour and transparency, out of a maximum of nine points. The findings are set out in Table 1 below and summarised in Figure 1 below.

Of the eight 5G landscaping reports that were assessed, the one assessed to have the highest rigour and transparency score is a 5G landscaping report authored by David Cooper, Johanna Dwyer and Alexander Haimovich (Cooper et al.). The paper summarises the results and methodology of a 5G essentiality survey, which determined that 8% of 5G patent families are truly essential for 5G smartphones (excluding Ericsson’s patents as they funded the study).

The methodology followed by the reviewers involved a multi-hour study of each patent family (i.e. an average of seven hours per patent) by the authors, who are three very well-qualified and experienced experts. Each review resulted in the creation of a claim chart, mapping the patent in question to the relevant standard. The study also benefitted from the involvement of a statistician, who identified the sample of patent families to be reviewed and calculated the confidence levels and confidence intervals, which are revealed in the paper. The study is also transparent as to the identity of the party who funded the analysis, which is rare for a 5G landscaping report and is a positive indication, as transparency as to the identity of the funder increases accountability and overall transparency.

The 8% essentiality rate is significantly lower than the equivalent figure found by David Cooper in an earlier 4G study of 12%, suggesting that over-declaration has significantly increased. It is not clear why essentiality rates may have dropped in the 5G era, but the finding is not surprising as there have been increasing commercial, geopolitical, and legal incentives for companies to declare as many patents as possible, for example: (i) intense geopolitical competition for each of the US, Europe and China to show that they are not being left behind in the ‘5G patent race’; and (ii) legal decisions incentivising companies to declare sooner in each patent family’s life, when it is harder to accurately assess essentiality, such as Core Wireless v Apple.

Applying new essentiality audit data to declarations

In the previous article on 5G landscaping published in October 2020, essentiality audit data was used to chart the 5G patent family holdings of three leading companies: Ericsson; Huawei and Samsung. Since the Cooper et al. findings have become available following the publication of that article, the previous analysis has been updated accordingly.

Patent data

To update the analysis, patent census data requested from twoBirds Pattern of Bird & Bird - who was identified as offering the most robust and transparent available in the previous article - was used. The analysis:

Is based on ETSI data downloaded on April 11 2021 (filtered back to January 1 2021 to control for inconsistent delays in ETSI’s database);

Incorporates a jurisdictional quality filter, to capture just those patent families which contain at least one US and/or EP granted patent or application, to exclude less relevant patent families; and

Follows the methodology described in Appendix A of the Cooper at al. study to identify which ETSI declarations relate to the 5G standard.

Essentiality rates

For Ericsson’s essentiality rate, the figure from the Cooper et al. study is used. The Cooper et al. study estimated an Ericsson essentiality rate of 18.9%, which was calculated by comparing a count of Ericsson’s 5G claim charts with the number of 5G patent families declared by Ericsson (in both cases filtering to those families filed in the US and/or EP).

For Huawei and Samsung’s essentiality rate, prior company-specific essentiality data for these companies are used, adjusted to account for the industry-wide drop in essentiality rates going from 4G to 5G, but giving both companies the benefit of the doubt by only reducing their rates by the same proportion as the drop in Ericsson’s 4G to 5G essentiality rate. This may over-estimate the rates, for example, Huawei’s share of essential 5G patent families is found to be 9.3%, whereas it may be lower in reality.

For the rest of the industry’s essentiality rate, figures from the Cooper et al. study are used, adjusted to account for the three company-specific essentiality rates.

Results

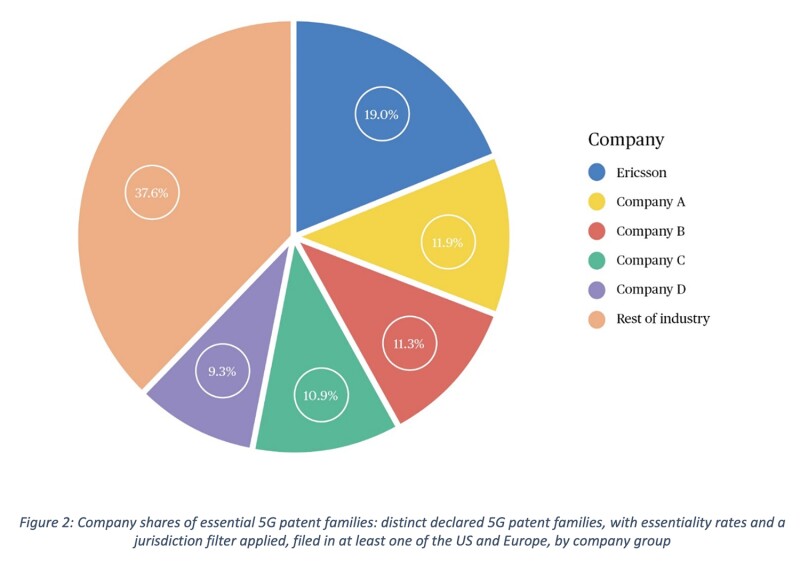

Figure 3 below shows the results of counting distinct (INPADOC) 5G patent families filed in at least the US or Europe, with essentiality and jurisdiction quality filters applied.

Ericsson has a 19% share of essential 5G patent families and the share held by other companies is 81%. However, although the share held by non-Ericsson companies is fixed, the exact share held by each company may be higher or lower than shown, as each company’s essentiality rate may be higher or lower than the essentiality rate applied (the adjusted industry average rate in most instances). The non-Ericsson company names have been anonymised, as the Cooper et al. study only identifies a company-specific essentiality rate for Ericsson.

Company shares of essential 5G patent families

For a more detailed version of this article, please click here

Robert L Stoll

Partner

Faegre Drinker Biddle & Reath

T: +1 202 230 5176

E: robert.stoll@faegredrinker.com

Robert Stoll is a former United States Patent and Trademark Office (USPTO) patent commissioner who applies more than 35 years of experience in intellectual property prosecution to advising clients on protecting inventions and the complexities of foreign and domestic intellectual property laws. He also advocates generally for the critical role of intellectual property in economic growth and job creation.

Bob advises clients about potential legislative and rule changes and helps them advocate their interests before the administration and the legislature. He frequently testifies in court as an expert witness in prosecution at the USPTO.