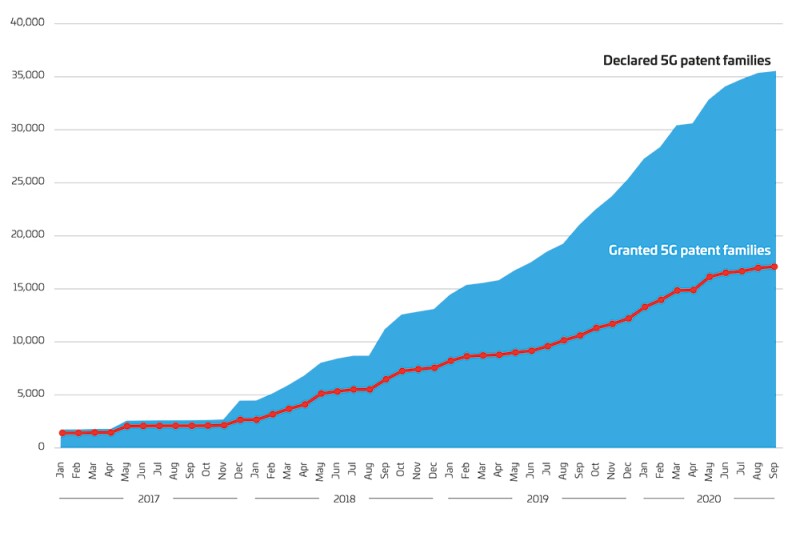

Figure 1 shows the cumulative number of 5G patent families from January 2017 to September 2020. The blue area shows declared 5G patent families by declaration month. The red line shows granted 5G patent families that have at least one granted patent as of October 5 2020. Some of the patent applications in the declared 5G patent families become granted patents over time. In each dot in the red line, we determined whether the declared 5G patent families in each declaration month have at least one granted patent as of October 5 2020, rather than as of each declaration month.

The substantial rise in declared 5G patent families started from around December 2017, and the number has grown continuously since then. This is mainly because the initial launch of 3GPP Release-15, which is a major release with respect to 5G technology, was frozen around Q4 2017 to Q1 2018. It was the first 3GPP release containing the full set of 5G standards. While initial specifications enabled non-standalone 5G radio systems to be integrated in previous-generation LTE networks, the scope of Release 15 expands to cover 'standalone' 5G, with a new radio system complemented by a next-generation core network. Features of 3GPP Release-15 include new radio, 5G system phase 1, massive machine-type communications and internet of things, vehicle-to-everything communications (V2X) phase 2, mission critical interworking with legacy systems, WLAN and unlicensed spectrum use, and slicing-logical end-to-end networks.

Figure 1: Cumulative number of declared 5G patent families counted by declaration month

As of October 5, 2020, Source: IPlytics platform

Figure 2 shows the top 15 companies by the number of declared 5G patent families (see column A), and the proportion of each company's patent families based on the total number of the declared 5G patent families (see column B). We integrated Nokia's data with that of its subsidiary Alcatel-Lucent.

We used the same order of the top 15 companies in Figure 2 when generating Figures 3, 5 and 6, respectively.

As Figure 2 shows, as of October 5 2020 the total number of declared 5G patent families was 35,392. Huawei (6,372 patent families) is in first place and accounts for 18% of the total. Other companies with more than 4,000 declared 5G patent families are Qualcomm (4,590, 13%) and Samsung (4,052, 11.4%). Comparing the data with NGB's data analysis as of May 17 2020, there was a noticeable increase (by 20%) in the total number of declared 5G patent families over the last five months (29,586 to 35,392). Huawei's growth rate is 7%, Qualcomm's is 67%, and Samsung's is 19%. Qualcomm has increased its number significantly, overtaking Samsung for second place. Along with these top companies, Sharp (growth rate: 79%), Catt (growth rate: 32%) and Vivo (growth rate: 51%) also show a significant growth. Xiaomi (462 patent families, 1.3%) has been a newcomer to the rankings in the last five months.

Figure 2: Number of declared 5G patent families by company

As of October 5, 2020, Source: IPlytics platform

Declaring company name |

A Number of declared 5G patent families* |

B Proportion of declared 5G patent families* A / Total (35,392) [%] |

Huawei Technologies |

6,372 |

18.0% |

Qualcomm |

4,590 |

13.00% |

Samsung Electronics |

4,052 |

11.40% |

Nokia Group |

2,690 |

7.60% |

LG Electronics |

2,666 |

7.50% |

ZTE |

2,665 |

7.50% |

Ericsson |

1,838 |

5.20% |

Sharp |

1,539 |

4.30% |

Catt |

1,465 |

4.10% |

NTT Docomo |

1,019 |

2.90% |

Intel |

998 |

2.80% |

Guangdong Oppo Mobile Telecommunications |

986 |

2.80% |

Vivo Mobile Communications |

616 |

1.70% |

InterDigital |

607 |

1.70% |

Xiaomi |

462 |

1.30% |

Others |

2,827 |

8.00% |

Total |

35,392 |

100.00% |

* Both granted patent families and non-granted patent families

Figure 3 shows, for the top 15 companies, the number of granted 5G patent families (see column C) and the proportion of each company's granted 5G patent families based on the total number of granted families (see column D).

While Huawei (2,993) is still first in the ranking, Samsung (2,628) in second place closes the gap with Huawei compared with the situation in Figure 2 (Huawei: 6,372 patent families; Samsung: 4,052). Compared with Figure 2, Figure 3 shows that Huawei's proportion has decreased by 0.6 points and Samsung's has increased by 3.9 points. ZTE, Catt, Intel, Oppo, Vivo and Xiaomi have a smaller proportion of granted 5G patent families when compared with Figure 2. It is likely that these companies have more families with an application under examination.

Figure 3: Number of granted 5G patent families by company

As of October 5, 2020, Source: IPlytics platform

Declaring company name |

C Number of granted 5G patent families* |

D Proportion of granted 5G patent families* C / Total (17,179) [%] |

Huawei Technologies |

2,993 |

17.4% |

Qualcomm |

2,323 |

13.50% |

Samsung Electronics |

2,628 |

15.30% |

Nokia Group |

1,963 |

11.40% |

LG Electronics |

1,663 |

9.70% |

ZTE |

555 |

3.20% |

Ericsson |

948 |

5.50% |

Sharp |

967 |

5.60% |

Catt |

283 |

1.60% |

NTT Docomo |

460 |

2.70% |

Intel |

200 |

1.20% |

Guangdong Oppo Mobile Telecommunications |

83 |

0.50% |

Vivo Mobile Communications |

34 |

0.20% |

InterDigital |

386 |

2.20% |

Xiaomi |

61 |

0.40% |

Others |

1,632 |

9.50% |

Total |

17,179 |

100.00% |

* including at least one granted patent

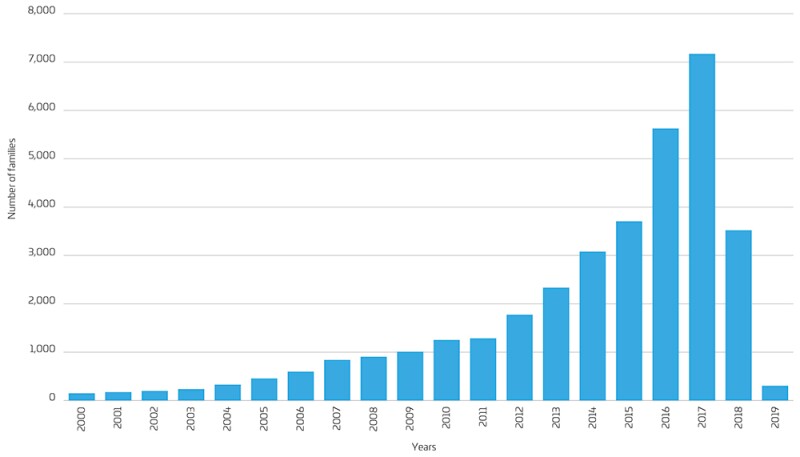

Figure 4 shows the distribution of the priority years of the declared 5G patent families. We can see an increasing trend of declared 5G patent families having priority from the year 2012 to 2017. This is mainly because the initial launch of 3GPP Release-15 was frozen around Q4 2017 to Q1 2018. Usually, companies try to file a patent well before a standard is frozen so that they can declare their patents (granted or applications) as essential to that standard. Sometimes, they can also influence a particular feature to be included in the standard mainly because they already had a relevant granted patent.

Figure 4: Priority years of declared 5G patent families

As of October 5, 2020, Source: IPlytics platform

Figure 5: Countries of declared 5G patent families

As of October 5, 2020, Source: IPlytics platform

Declaring company name |

Published country of declared 5G patent families* |

|||||

US |

EP |

JP |

CN |

KR |

Total** |

|

Huawei Technologies |

3,921 |

3406 |

1,134 |

5,833 |

921 |

6,372 |

Qualcomm |

4,495 |

2856 |

1,991 |

3,075 |

2,058 |

4,590 |

Samsung Electronics |

3,626 |

2062 |

956 |

2,109 |

3,268 |

4,052 |

Nokia Group |

2,279 |

2152 |

870 |

1,503 |

772 |

2,690 |

LG Electronics |

2,151 |

1132 |

720 |

1,096 |

1,730 |

2,666 |

ZTE |

544 |

490 |

228 |

2,660 |

142 |

2,665 |

Ericsson |

1,272 |

1185 |

493 |

922 |

320 |

1,838 |

Sharp |

1,228 |

827 |

1,259 |

999 |

70 |

1,539 |

Catt |

118 |

122 |

35 |

1,421 |

60 |

1,465 |

NTT Docomo |

609 |

595 |

978 |

608 |

194 |

1,019 |

Intel |

883 |

186 |

128 |

293 |

144 |

998 |

Guangdong Oppo Mobile Telecommunications |

236 |

291 |

136 |

950 |

233 |

986 |

Vivo Mobile Communications |

13 |

14 |

616 |

616 |

||

InterDigital |

564 |

395 |

339 |

387 |

331 |

607 |

Xiaomi |

135 |

92 |

15 |

457 |

28 |

462 |

Total*** |

24,313 |

17,364 |

10,251 |

24,831 |

11,303 |

35,392 |

*: both granted patent families and non-granted patent families

**: the number of declared 5G patent families per company

***: the total number not just from the top 15 companies but from others too

Figure 5 (see above) shows the distribution of the countries of the declared 5G patent families. China and the US are the most popular countries/jurisdictions of declared 5G patent families, followed by the EPO. Further, China reportedly has the most number of active 5G users: 110 million. According to Figure 5, Huawei has the highest number of declared 5G patent families in China and at the EPO; Qualcomm has the most in the US and Japan, and has a large number outside of its home country (which is the US). On the other hand, ZTE (China), Catt (China), Intel (US), Oppo (China), Vivo (China), InterDigital (US) and Xiaomi (China) have a large bias towards declared 5G patent families in their home countries.

Figure 6 shows the distribution of the technical specification groups (TSGs) of the declared 5G patent families. The three main TSGs are radio access network (RAN), services/systems aspects (SA), and core network and terminals (CT). RAN defines radio communications between user equipment (UE) and the core network. SA is responsible for overall architecture and service capabilities. CT is responsible for the core network. All of the top 15 companies declare more 5G patent families in RAN compared with SA and CT. This is because the majority of the enhancements of 5G technology lie within the radio access part of the network. Huawei and Nokia have a larger number of patent families in SA and CT than the other 15 companies, and it is expected that they are also actively working on standardisation in these areas.

Figure 6: Technical specification groups of declared 5G patent families

As of October 5, 2020, Source: IPlytics platform

Declaring company name |

Number of declared 5G patent families* |

|||

RAN |

SA |

CT |

Total** |

|

Huawei Technologies |

4,934 |

1,338 |

275 |

6,372 |

Qualcomm |

4,085 |

522 |

182 |

4,590 |

Samsung Electronics |

3,706 |

488 |

143 |

4,052 |

Nokia Group |

1,653 |

884 |

397 |

2,690 |

LG Electronics |

2,533 |

79 |

80 |

2,666 |

ZTE |

2,419 |

185 |

145 |

2,665 |

Ericsson |

1,614 |

183 |

127 |

1,838 |

Sharp |

1,409 |

88 |

86 |

1,539 |

Catt |

1,312 |

132 |

13 |

1,465 |

NTT Docomo |

986 |

28 |

46 |

1,019 |

Intel |

947 |

68 |

59 |

998 |

Guangdong Oppo Mobile Telecommunications |

965 |

30 |

6 |

986 |

Vivo Mobile Communications |

598 |

12 |

13 |

616 |

InterDigital |

492 |

123 |

89 |

607 |

Xiaomi |

461 |

1 |

4 |

462 |

Total*** |

30,236 |

4,669 |

2,069 |

35,392 |

*: both granted patent families and non-granted patent families

**: the number of declared 5G patent families per company

***: the total number not just from the top 15 companies but from others too

Takeaways

What we have learned from this analysis:

1) Huawei is in the leading position in the number of declared 5G patent families, followed by Qualcomm and Samsung, and Huawei has the largest number of declared 5G patent families in China and at the EPO.

2) There was a noticeable increase (by 20%) in the total number of declared 5G patent families from May to October.

3) China and the US are the most popular countries/jurisdictions of declared 5G patent families, followed by the EPO.

4) All of the top 15 companies declared maximum number of 5G patent families in RAN compared with SA and CT.

We hope that this report helps many stakeholders in 5G technology to have more practical discussions and make better determinations.

Yuji Orita is general manger, and Toshihiro Nakane group leader, at NGB IP Research Institute in Tokyo.