Along with the development of IoT and AI technologies, there has been an increasing need to utilise information and communication technologies (ICT) standards in various fields such as automobiles, home appliances, robots and industrial systems. Accordingly, it is critical, not only for the ICT industry but for other industries as well, to closely monitor leading cases on standard essential patents (SEPs) with a fair, reasonable and non-discriminatory (FRAND) licence.

While Qualcomm has been achieving the highest rank in the SEP licensing market in terms of the volume of its SEPs as well as the amount of royalty earned, its unique licensing practice caused conflicts with national antitrust authorities in all IP5 countries. In particular, legal actions associated with SEPs and FRAND commitments were brought against Qualcomm in South Korea and the United States, with leading global companies, including Samsung, Apple and Huawei, participating in both the US and Korean cases.

The Korea Fair Trade Commission (KFTC) and the Seoul High Court imposed sanctions on Qualcomm against the anticompetitive conduct it exhibited when licensing out its SEPs. This is effectively a win for competitor and customer companies of the SEP holder.

Case history

Although the parties of the case at issue in Korea are seemingly Qualcomm and KFTC, a number of other ICT companies were also involved in the case. You can see why by reviewing the history of the dispute as summarised below.

The KFTC decided to institute an investigation of Qualcomm's licensing practice in February 2015 alleging that Qualcomm violated the Korean Antitrust Law. During this investigation, Qualcomm's rival and customer companies intervened in the action to assist the KFTC and actively cooperated to submit their own briefs and certain confidential materials corroborating arguments contained in the briefs. After thorough review on the merits, the KFTC issued an order for Qualcomm to correct its licensing practice in January 2017 (Case No. 2017-025).

Qualcomm brought a suit against the KFTC's administrative order before the Seoul High Court, and the above-mentioned companies participated in the litigation procedure in support of the KFTC. Samsung and Apple, who were among the interveners, eventually reached a settlement with Qualcomm whereas LG, Intel, Huawei and MediaTek remained until the KFTC won the suit in January 2020 (Case No. 2017Nu48).

Qualcomm appealed to the Supreme Court, and the above four companies are defending the appeal together with the KFTC (Case No. 2020Du31897).

Each party's position in the supply chain

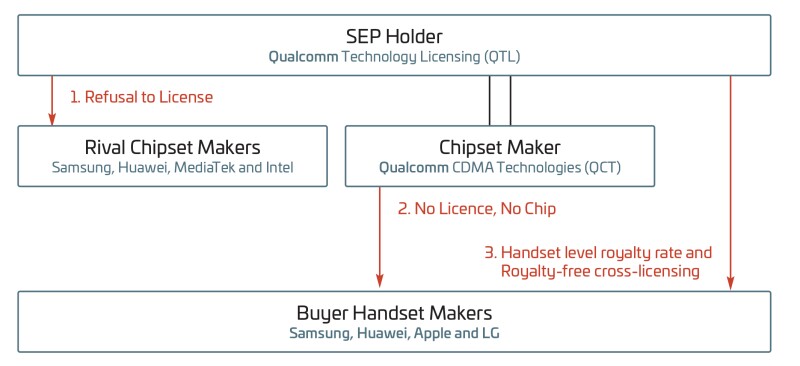

Qualcomm is the holder of SEPs and also the supplier of modem chips in which the inventions of the SEPs are implemented.

Intel and MediaTek, being baseband chipset suppliers, are direct competitors of Qualcomm. LG and Apple are SEP licensees and handset manufacturers, which purchase modem chips from Qualcomm. Samsung and Huawei make both the chipsets and smartphones, and also need a licence agreement with Qualcomm.

Fig.1: Qualcomm’s licence model

Qualcomm's licence model

Qualcomm allegedly has monopoly power over modem chips and breached FRAND commitments through its anticompetitive conduct under the Korean Antitrust Law. Alleged illegal acts at issue can be categorised into three.

Firstly, Qualcomm refused to grant an exhaustive SEP licence to rival chipset suppliers. Instead, it offered a non-exhaustive agreement such as a covenant not to sue. Such a refusal to licence policy prevented Qualcomm's patent rights from being exhausted when the rivals manufactured modem chips by using Qualcomm's patented technology. Although Qualcomm did not raise any claim against the competitors' modem chips, it seemed possible that Qualcomm could claim its patent rights against the handsets installed with the competitors' modem chips.

Secondly, Qualcomm required smartphone makers (i.e. buyers of its modem chips) to sign a separate SEP licence agreement before (or during) supplying its modem chips to them. This is a so-called no licence, no chip policy. As such, Qualcomm was in a position where it could threaten to cut off the modem chip supply and technical support to the smartphone companies at any time.

Lastly, based on the dominant position built up by the mentioned policies, Qualcomm concluded licence agreements with the smartphone manufacturers under terms and conditions favourable to itself. In particular, the royalty rate was calculated based on the unit of handset, not the unit of modem chip for every patent. Further, the licence terms included a royalty-free cross-licensing provision which set up a patent umbrella centred on Qualcomm.

KFTC order

According to the KFTC, Qualcomm's strategies were as follows: excluding rival chipset companies from the market by a refusal to licence policy; forcing a no licence, no chip policy on handset companies; setting the royalty rate at handset level to raise the amount; and building a Qualcomm-centred "patent umbrella" to protect itself from rivals' patents. As a result, its monopoly position could be further strengthened in both the SEP and modem chip markets, and the refusal to licence policy and the no licence, no chip policy could be maintained based on its monopoly power.

The KFTC decided that those licensing practices constituted anticompetitive conduct which violated the Antitrust Law. The KFTC ordered Qualcomm to take corrective measures for the illegal conduct and also imposed a penalty of about 1 trillion won (about $837 million). This penalty amount is the highest amount ever since the establishment of the KFTC. Qualcomm appealed against this administrative order to the Seoul High Court.

Seoul High Court decision

The Seoul High Court's decision is as follows: (i) as for the refusal to licence and no licence, no chip policies, Qualcomm's practices are illegal and the KFTC's remedies are appropriate; (ii) with regard to the KFTC's corrective measure for the licensing terms, however, Qualcomm's conduct is not illegal and the KFTC's measure is inappropriate; (iii) lastly, despite the inappropriateness of the KFTC's measure regarding the licensing terms, the penalty order is appropriate in its entirety since the former two conducts are illegal.

With respect to the above two policies, the High Court decided that Qualcomm violated its obligation to negotiate FRAND licences in a diligent manner by simply refusing to licence its SEPs to rival chipset suppliers. The court required Qualcomm to make exhaustive licences available to willing licensees under fair, reasonable and non-discriminatory terms.

The High Court also ruled that Qualcomm should not condition its supply of modem chips on the buyer's status as a patent licensee and must negotiate with the buyer under FRAND terms. Among other points, it was stressed that the SEP holder's unilateral decision to suspend the modem chip supply would cause more severe harm to the buyer than an injunction that might be issued by the court.

On the other hand, the court held that although the favourable licence terms are the results of the two anticompetitive conducts discussed above, the royalty rate at handset level and the royalty-free cross-licensing are not illegal per se.

Remarks

The Seoul High Court's decision puts the brakes on Qualcomm's licensing practice while taking the KFTC's side and, at the same time, rival chipset makers' and handset companies' side as well. Qualcomm filed an appeal against the decision and the appeal is currently pending before the Supreme Court.

SEPライセンスを巡る争い

クアルコム:韓国公正取引委員会(KFTC)

近年、情報通信技術の融合・複合と相まって、様々な分野において標準化が加速している。標準必須特許(SEP)の確保が企業の競争力、ひいては国の競争力を左右するとの認識が広まっている中、SEPライセンスを巡る紛争には、関連企業のみならず国際的な関心が寄せられている。

SEPライセンス市場で、クアルコムは比類のない地位を占めている。クアルコムは、SEPライセンスにおいて独自のユニークなビジネスモデルを築き上げ、長期間にわたり移動通信分野で市場支配的影響力を行使してきた。ところが、クアルコムのライセンスモデルは、反競争的行為であるという反発を呼び、IP5のすべての競争当局との紛争が相次いでいる。とりわけ、韓国とアメリカでは、FRAND宣言といった同じイシューを巡って現在も紛争が続いており、サムスン、アップル、ファーウェイなど業界のキープレーヤーの殆どが関連裁判に参加しているのが実情である。本稿では、韓国における争いについて紹介する。

1. 事件の経過

かかる紛争は、表向きにはクアルコム対韓国公正取引委員会(KFTC)だが、実際にはクアルコム対他のメーカーとの争いであるとも言える。それはなぜか、事件の経過を見るとその理由が見えてくる。

KFTCは2015年、クアルコムに独占禁止法違反の疑いがあるとし、調査に着手した。クアルコムの競合他社及び顧客企業がこの調査に積極的に協力し、膨大な量の内部資料と主張・意見を提出した。これに基づき、KFTCは2017年1月にクアルコムに対してライセンスモデルを是正する旨の処分を下した(議決第2017-025号)。

クアルコムはKFTCの行政処分に不服の訴えを提起した。ソウル高等裁判所では、前述の企業らが訴訟手続きに直接参加しクアルコムを攻撃した。このうち、サムスン、アップルは途中でクアルコムと和解し参加を取りやめた。一方、LG、インテル、ファーウェイ、メディアテックは最後まで残り、2020年1月にKFTCに勝訴を導いた(ソウル高裁2017Nu48)。

これに対しクアルコムは上告し、前記4社は韓国の最高裁判所の訴訟にも参加している(最高裁2020Du31897)。

2. サプライチェーンにおける各企業の位置づけ

クアルコムは標準必須特許の保有者でありながら、これを具現するモデムチップを製造するチップセットメーカーである。

インテル、メディアテックもチップセットメーカーで、クアルコムの直接的なライバルである。LG、アップルは端末メーカーで、クアルコムからモデムチップを購入する顧客であると同時に、SEPのライセンシーでもある。サムスン、ファーウェイはモデムチップとスマートフォンの両方を製造し、ライセンスを必要としている。

3. クアルコムのライセンスモデル

クアルコムは独占事業者としてFRAND義務を破るなど独禁法に違反したと言われている。問題のクアルコムの行為は大きく3つに分けられる。

1つ目、クアルコムは、ライバルのチップセットメーカーに対して、SEPに関するライセンス契約を拒絶する。その代わり、不争契約を提案・締結する。このような「ライセンスの拒絶」施策を通じて、ライバルのモデムチップにおいて、ライセンスにより特許権が消尽することを防ぐのである。ライバルのモデムチップ自体に関しては争わないが、そのモデムチップが搭載されたスマートフォンに対しては特許権を主張できる状態にするものと言える。

2つ目、クアルコムは、端末メーカーに対して、モデムチップを供給するためには、SEPライセンス契約を締結することを求める。これはいわゆる「ノーライセンス・ノーチップ」と呼ばれている。このような施策でクアルコムは、ライセンスの履行という武器を持ち、端末メーカーに対するモデムチップの供給をいつでも拒絶したり中断したりできる立場となるのだ。

最後に、この2つの行為で築き上げた有利な地位をもとに、端末メーカーに対して有利な条件でライセンス契約を締結する。特に問題となるのは、全ての特許に対しロイヤルティーの算定基準をモデムチップの価格ではなく、「端末のレベル」にすることだ。さらに、無償のクロスライセンスを契約の条件にし、自分を中心とした「特許の傘」を作ることである。

4. 韓国公取委の処分

要するに、クアルコムの戦略は次の通りである。ライセンスの拒絶を通じてライバルのチップセットメーカーを市場から排除すると同時に、端末メーカーに対しノーライセンス・ノーチップを強制する。よって、ロイヤルティーの算定基準を端末のレベルに上げて高い利益を得るとともに、クアルコム中心の特許の傘を作ってライバルを排除する。その結果、SEPとモデムチップの両市場において自分の独占力をさらに強める。その独占力をもとに、ライセンスの拒絶そしてノーライセンス・ノーチップ戦略を維持するのだ。

KFTCは前述の行為が反競争的行為に該当すると判断した。そして、違法行為の是正を命じるとともに、約1兆ウォン(約1千億円)の課徴金の支払いを命じた。この課徴金はKFTCの発足以来最高額である。クアルコムは不服を申し立てた。

5. ソウル高等裁判所の判決

ソウル高裁は次のように判示した。ライセンスの拒絶、及びノーライセンス・ノーチップに関してはKFTCの是正命令は妥当、つまり、クアルコムの2つの行為は違法である。その一方、ライセンスの条件に対するKFTCの是正命令は不当、つまり、クアルコムの行為は違法ではない。ただし、2つの行為が違法である以上、これに基づいて算定された課徴金は全額適法である。

チップセットメーカーに対するライセンスの拒絶が違法だとされたのは、SEPに関するFRAND義務に完全に反するというのが最も大きな理由だった。クアルコムは実施を希望する者に対して、ライセンス交渉に誠実に臨み、また公正かつ合理的な条件で契約を締結すべきとのことだ。

端末メーカーに対するノーライセンス・ノーチップの違法性でも、FRAND宣言が問題となった。とりわけ、SEPの保有者が一方的な判断でモデムチップの供給の中断を決めることは、裁判所が差し止めを命じることよりも強力なため許されないとした。

その一方、有利なライセンスの条件は、前述の2つの行為による結果であり、端末レベルのロイヤルティーの算定や無償のクロスライセンス自体は違法ではないと判断された。

6. 結び

ソウル高裁はクアルコムのライセンス戦略を否定し、さらに課徴金の支払い額をそのまま維持した。KFTCの勝訴となったソウル高裁の判決は、事実上、ライバルのチップセットメーカーと端末メーカーの勝利とも言うべきであろう。かかる判決に対してクアルコムは上告し、本事件は現在最高裁に係属中である。

Sehwan Choi

崔 世煥(チェ セファン)

Dr Sehwan Choi is a patent attorney admitted to the Korean Patent Bar. As a seasoned member of FirstLaw, a top-tier IP firm based in Seoul, he has accumulated extensive experience in filing and prosecuting patent applications, providing expert opinions, and handling IP trials and litigations, in the fields of ICT, semiconductors, vehicles and materials. He has also served as an expert commissioner before the court and an examiner at the Public Procurement Service at the Ministry of Economy and Finance.

After receiving his BS degree in mechanical and aerospace engineering from Seoul National University, he continued studying control and electrochemical processes at graduate school, while working as a research scientist at an institute belonging to the same university, and obtained his PhD degree.

Dr Choi completed an LLM course at Waseda University and also worked at an IP law firm in Tokyo. He has given a lot of presentations before various audiences in Japan as well as Korea to share his expertise in technical and legal areas. Armed with a profound understanding of the Japanese IP system, he, along with his team at FirstLaw, provide Japanese clients with customised legal services.

第一特許法人(FirstLaw P.C.)

弁理士 工学博士

学 歴:ソウル大学 機械航空工学部(B.S)、ソウル大学大学院 機械工学部(Ph.D.)、早稲田大学大学院 法学研究科(LL.M.)

経 歴:ソウル大学 共同研究所、韓国の特許事務所、日本の特許事務所(東京)

崔世煥氏は、情報通信、電気、機械、材料など幅広い分野において、特許出願、審判・訴訟、鑑定など様々な業務にあたり大きな成果を収めてきた。また、技術、IP、法律にわたる専門性をもとに、韓国のみならず日本でも多くの講義を行ってきた。崔氏ならびに第一特許法人は、日本の知財システムに関する多様な経験と理解をもとに、日本クライアントに最適なIPサービスを提供している。