Alibaba’s upcoming US initial public offering (IPO) has been dominating financial news headlines. From speculation as to which exchange will have the privilege of hosting the Chinese internet company to its eye-popping valuation (likely higher than 95% of the S&P 500), the chatter about Alibaba has been nonstop.

Alibaba’s growth also highlights the challenge for Chinese brands. Though the National IP Strategy lists the development of world-renown Chinese brands as one of its main goals, China has had more success thus far in meeting their patent-related targets, such as becoming the world's biggest patent filer. Other than several notable exceptions such as Alibaba and Lenovo, Chinese brands have not made as much progress establishing themselves abroad; for example, no Chinese companies made InterBrand’s list of the 100 most valuable global brands.

|

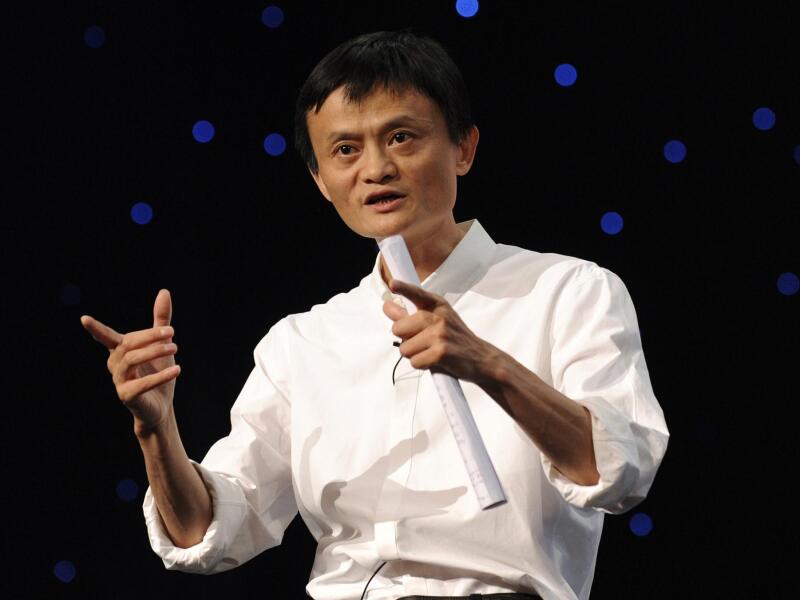

Alibaba founder Jack Ma. Though Ma stepped down as CEO last year, he is still active In the company and known for aggressively expanding into new markets |

Meanwhile, in InterBrand’s most recent table of the most valuable Chinese brands, the top three brands are China Mobile, China Life and China Construction Bank, all companies that have little to no presence in the US or Europe. This may suggest that Chinese companies were doing healthy business expanding in their home markets, and had less need to compete against more established brands abroad.

Opportunities abroad

Things may be changing. IP Australia’s 2014 IP Report released last week noted that trade mark filings from China increased by 20% in the last year to 1,484 applications. By comparison, the third biggest international filer, Germany, had 1,527 filings. The leading international filer, the US, had 7,814 filings.

USPTO data tell a somewhat similar story. There were 4,756 applications from Chinese residents in 2013, a 27% increase over the previous year. Relative to other countries, these numbers are not as striking as those in Australia. This puts the number of Chinese applications slightly ahead of those from Italy (4,382) or Australia (3,960), though slightly behind countries like Germany, which had over 10,000 US trade mark filings in 2013.

Managing IP’s China in-house survey also shows considerable interest in filing marks abroad. The data, collected last year at the MIP China-International IP Forum in May, shows that over 70% of respondents intend to increase international filings.

Building successful brands goes far beyond just filing a lot of applications. China’s own experience with sparking innovation is a lesson in this; despite reaching its much-lauded goal to be the biggest patent filer in the world, there are still questions about whether these policies to encourage patent filings is leading to sustainable innovation, though it has been working to improve patent quality in the past year.

So perhaps there is a certain logic to this quantity then quality pattern; as more Chinese companies file marks and start doing increasing business broad, certain brands will build a stronger reputation and eventually grow to be a global brand.

Alibaba then may be a sign of things to come. Though several Chinese companies list on US exchanges without doing much business there, Alibaba has already made a name as an international business-to-business marketplace. Given the breadth of its businesses in China, it may well be looking to expand its other businesses into the US. If it is successful, it may just be the first of a new wave of international Chinese brands.