This year’s IP Strategy Report from intellectual property analytics company Aistemos studies the impact of technology in financial services, aerospace and defence and the automotive industry as well as the impact of Industry 4.0.

Among the report’s interesting findings are insights into disruption in IP.

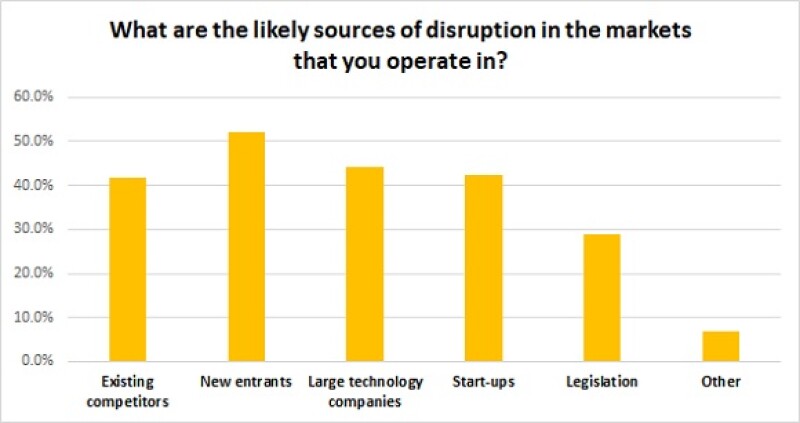

Respondents were asked to identify the likely sources of disruption. The highest scores were for disruption from new entrants (52.1%), large technology companies (44.2%), start-ups (42.5%) and existing competitors (41.7%). The ”Other” category included Brexit, court decisions and standards.

The report says established technology companies will have a bigger role to play as a result. “In this category are both the well established (e.g. IBM, HP, Intel) and the newly established technology companies (e.g. Google, Amazon, Apple),” it says. “This cohort, taken as a whole, understand the importance of patents, and know exactly how best to leverage intangible assets to deliver tangible returns.”

The report warns to “expect higher levels of patent litigation”. Aistemos’ research suggests an era where there is widespread acceptance of the need for more collaboration. “At the same time, while the automotive sector is hoping for the best, they are preparing for the worst,” says the report.

The survey also asked about technologies that will cause the disruption, with a broad range of technologies given. Artificial intelligence (75.8%) leads, then the Internet of Things (44.2%), closely followed by blockchain (42.4%).

The report explained: “What is reinforced by the sector studies is how universally applicable these technologies will be. Using AI and machine learning as an example, it has a broad application. For example in fintech, it is being deployed in the back-office (risk assessment) and on the front line interacting with customers. Both automotive and A&D are investing in AI for autonomy on land, air and sea. Other sectors embracing AI include healthcare (the primary focus for IBM Watson), retail (recommendation engine) and social media (face recognition).”

Nigel Swycher, CEO of Aistemos, and Steve Harris, its CTO, will be taking part in a session about the impact of artificial intelligence on IP strategy at Managing IP’s IP Corporate Strategy Summit. The event has free registration for senior IP counsel, general counsel and heads of legal. More details can be found here. To apply for a place email registrations@managingip.com.