South Korea is following a roadmap to commercialise Level-4 autonomous vehicles by 2027. Further, the environment is favourable for quick, accurate, and reliable patent protection through various systems, such as newly updated patent examination guidelines and accelerated examination available for autonomous vehicle inventions.

Among other factors, autonomous vehicles absolutely rely on ‘sensor’ technologies to perceive their surroundings and navigate without any human intervention. Currently, cutting-edge sensor technologies for autonomous vehicles are rapidly growing. The emerging ‘camera–LiDAR (light detection and ranging) sensor convergence’ technology enhances the reliability of autonomous driving by uniting camera and LiDAR information, and is used in fully autonomous vehicles of Level 4 or higher.

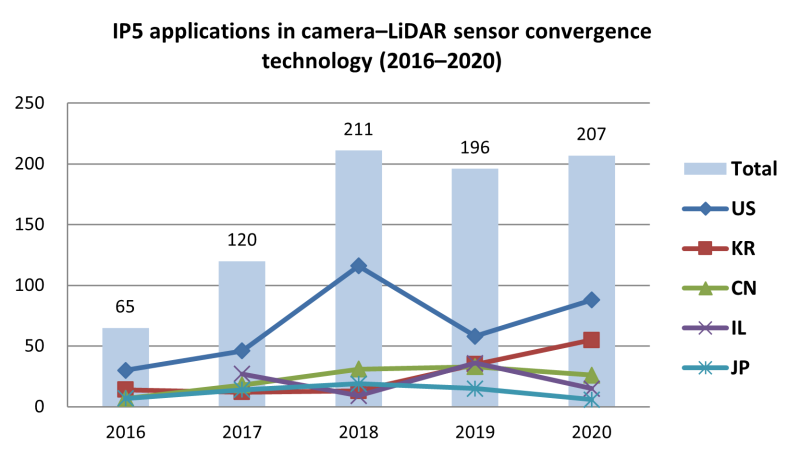

On May 4 2023, the Korean Intellectual Property Office (KIPO) released the noteworthy results of a survey on worldwide patent filings for the camera–LiDAR sensor convergence technology. KIPO’s analysis of patent applications filed with the major five Intellectual Property Offices, the IP5 (KR, US, EU, CN, and JP), reveals the number of patent applications for the camera–LiDAR sensor convergence technology has significantly increased over the past five years with an average annual growth rate of 33.6%.

Strong growth from South Korea and China

The top five countries of origin for IP5 applications from 2016 to 2020 were the United States (338 cases), South Korea (129 cases), China (115 cases), Israel (87 cases), and Japan (61 cases). South Korea has shown a sharp rise in the average annual growth (40.8%), followed by China (38.8%), and the United States (30.9%).

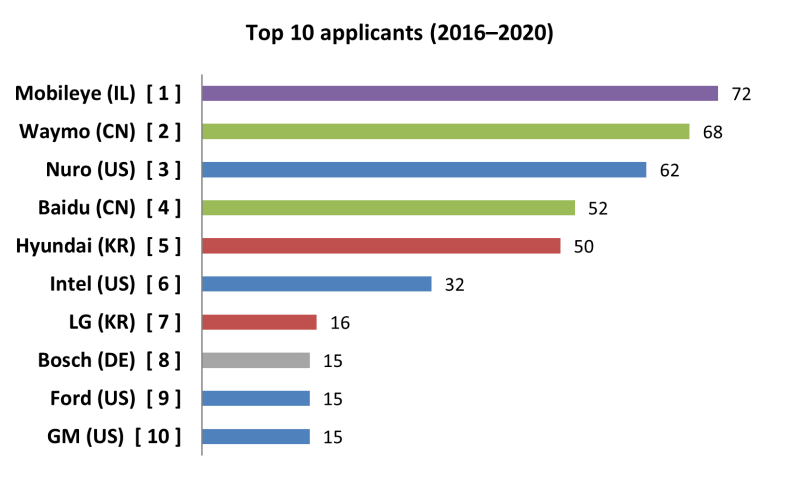

Two Korean companies ranked in top 10 players

Leading players were Mobileye from Israel (72 cases), followed by Waymo (2nd, 68 cases), Nuro (3rd, 62 cases), Baidu (4th, 52 cases), and Hyundai (5th, 50 cases). Among Korean applicants, Hyundai Motor Company (5th) and LG (7th, 16 cases) ranked in the top 10, with Samsung ranked 17th (11 cases) and Mando 20th (nine cases).

Most applications came from companies

Companies led the filings with a proportion of 95.0%, followed by individuals (2.6%), universities (1.3%), and public research organisations (1.1%). This suggests that companies are in fierce competition to preemptively occupy camera–LiDAR sensor convergence technologies.

KIPO’s relevant patent practice

KIPO issued new patent examination guidelines for autonomic vehicle inventions in 2022, and further published a relevant examination casebook in January 2023. The following patentability issues are worth noting.

Enablement:

KIPO considers the state of the relevant technology (e.g., SAE autonomous driving level) at the time of filing a patent application when determining whether the application meets the so-called enablement requirement. This requires that the specification should be described as to enable a person of ordinary skill in the art (POSITA) to readily practice the invention. For example, in a case where an application claims a Level-5 autonomous vehicle, but the SAE autonomous level existing at the time of filing was Level 2, it can be regarded as failing to meet the enablement requirement. This is unless the specification discloses specific technical means such that POSITA can reproduce the claimed Level-5 autonomous vehicle without undue experimentation or trial and error.

Patent eligibility:

According to KIPO’s guidelines, an autonomous vehicle invention is not patent-eligible if its implementation will inevitably lead to a violation of public order, regulations (e.g., traffic laws), or morality. For example, an invention that controls a vehicle to drive over the speed limit for quick arrival at a destination, or an invention involving an algorithm to control a vehicle based on an ethical choice of deciding which person to save in a situation where injuries/casualties are inevitable (e.g., the ‘trolley dilemma’) may not be patentable. However, an exception may apply if the violation was for a reasonable purpose in view of the description and claim limitations, such as an ambulance or fire truck in an emergency.

Inventive step:

To assess the inventive step of autonomous vehicle inventions, even those prior art references which are not pertinent to the technical field of autonomous vehicles can be combined with relevant autonomous driving prior art. This is because autonomous vehicle inventions are achieved through the convergence of different technologies such as sensors, information and communication, and computer technologies in addition to existing automobile technologies. For example, when assessing the inventive step of an invention for a LiDAR system for detecting road surfaces by performing intensity correction on LiDAR point cloud data to improve the reliability of road surface detection data, it is possible to cite a prior art reference from a different field. For example, using similar technology that uses intensity correction to enhance the accuracy of distance measurement for buildings and terrain would be applicable, since the problem to be solved by the invention (enhancing the data reliability by intensity correction) is the same as that of the prior art reference.

Final thoughts

Needless to say, to lead the fast-growing autonomous vehicle market, it is critical that patents be secured for core technologies such as sensor convergence technologies for Level 4 or higher. Hopefully the IP environment and Korean patent practice regarding autonomous vehicles discussed above can provide insights to anyone interested in patenting autonomous vehicles in Korea.