In the future, half of the world’s data volume will no longer be generated by or between people but by vehicles, sensors, or other various types of networked devices, according to some predictions.

Not only the number of devices but also the volume of data continues to increase dramatically. Telecom equipment supplier Ericsson estimates that global data traffic will increase fivefold to 136 exabytes per month within the next five years, compared to today. The expectation is that a typical end user will generate up to 1.5 gigabytes of data per day, and a vehicle with up to 4 terabytes even several times that amount.

The 3GPP (3rd Generation Partnership Project), the organisation responsible for cellular standards development, already had these new requirements in mind when it defined the fifth-generation mobile network 5G. At its core, 5G was about offering significantly higher data rates (100 times higher than 4G/LTE), enabling latency times in the millisecond range, and providing significantly higher availability and reliability of the network.

However, the significant increase in the number of end devices, the explosion in the volumes of data exchanged, and the need for minimum latency times are placing new demands which 5G technology alone may not meet.

The concept of edge computing provides a solution. The idea behind it is simple: bring the cloud with its computing capacity closer to the users and thus achieve runtimes of less than 10 milliseconds but without losing the advantages of the cloud. In simpler terms, edge computing means running fewer processes in the cloud and moving those processes to local devices, such as on a user’s smartphone, computer, an internet of things device, or an edge server. Bringing computation to the network’s edge minimises the amount of long-distance communication that must happen between client and server.

The processing of vehicle data in the context of autonomous driving is often cited as a relevant use case for edge computing. Vehicles stand still for an average of 96% of their lifetime – here, the load-balancing advantage of edge computing becomes very clear: you do not necessarily have to install expensive components in every vehicle, but instead shift the logic to an edge computing device that can serve a large number of vehicles.

The potential for weight and cost reduction through edge computing devices can be illustrated, for example, by the complex image processing and video analysis of camera drones. And one can expand the application scenarios infinitely: from the implementation of blockchain logic in production, logistics and supply chains to the complex calculation of augmented and virtual reality models, for example for plant technicians during installation or maintenance work, to the real-time control of production plants, and so on.

While the edge computing concept may reduce the volume of communication between device and the cloud, edge computing is still heavily dependent on connectivity standards such as 5G or Wi-Fi. Connectivity standards are often subject to thousands of patents and in some cases these patents claim inventions that read on the standardised technology. Such patents are referred to as standard essential patents (SEPs).

Companies that define and specify technologies such as 5G or Wi-Fi and that own essential patents for such technologies will be among the technology leaders in a soon fully connected world.

To get a better understanding of the landscape of patents, SEPs and standards contributions for edge computing technologies, the IPlytics Platform databases were used to analyse edge computing-related patent filing trends as well as to understand which companies develop the latest standards that enable edge computing and which companies hold essential assets on edge computing technologies.

Edging ahead

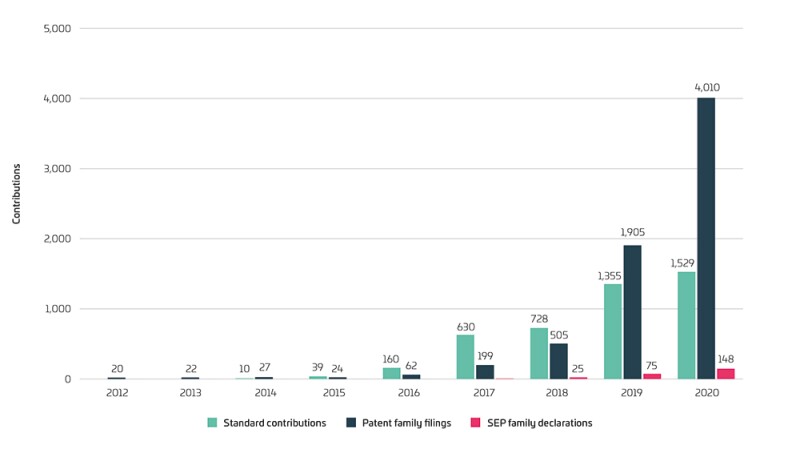

Figure 1 shows the number of submitted standards contributions per year, the number of patent families by publication year, as well as the number of SEP families by year of declaration that describe edge computing technologies.

The data confirms a sharp increase in patent filings, patent declaration and standards contributions. While the submission of standards contributions for edge computing sharply picked up in 2016 and 2017, patent filings exploded between 2018 and 2020 to a peak of 4,010 new family filings.

Also, between 2017 and 2020, the first patents that describe an edge computing technology were declared as standard essential, increasing to 145 newly declared patent families in 2020.

Figure 1: Number of standards contributions, number of patent families by publication year and number of SEP families by year of declaration that describe edge computing technologies (IPlytics Platform, April 2021)

It should be noted here that 5G technology does not necessarily have to be used to bridge the ‘last mile’ to the mobile end device. In industrial plants, alternative technologies such as wireless standards (Wi-Fi), which have similar performance characteristics to 5G, are also possible.

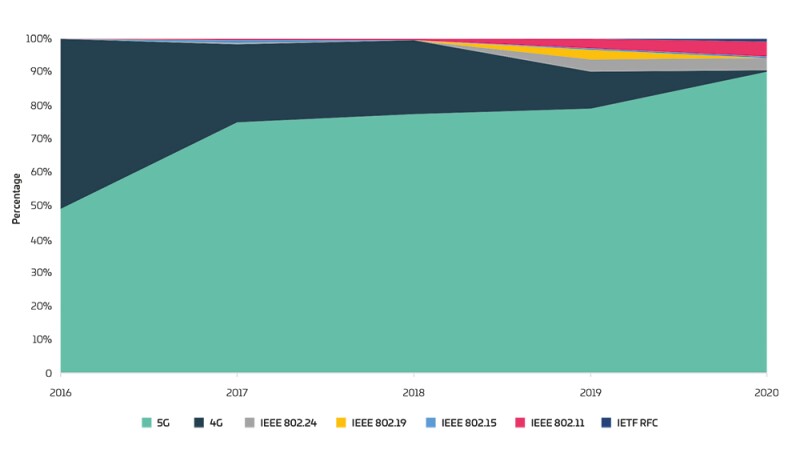

Figure 2, however, shows that most standards contributions describing edge computing have been submitted to connectivity standards such as 4G and 5G followed by local area network standards such as the IEEE 802.11 series (Wi-Fi) or the IEEE 802.24, IEEE 802.19, IEEE 802.15 series, as well as Internet Engineering Task Force standards.

Figure 2: Number of standards contributions that describe edge computing technologies, by standards technology (IPlytics Platform, April 2021)

The interplay between 5G and edge computing opens up new opportunities and areas of application for companies: 5G as a high-performance mobile communications technology and edge computing with its possibilities for the development of new smart services. To understand technology leadership for edge computing technologies, both data on standards contributions as well as on patent filings and SEP declarations were counted on the company level.

Table 1 shows the top 30 companies most active in patent filing, SEP declaration and standards development. The list of technology leaders shows some companies that do not yet participate in standards development, and thus also do not declare SEPs, but are still among the companies with most edge computing patent filings, such as SAS Institute (US), IBM (US), Pure Storage (US) and Microsoft (US).

These companies are typically active in the cloud business (IBM and Microsoft), or data and software sectors (SAS Institute and Pure Storage). Chip, handset and network manufacturers such as Huawei (China), Intel (US), Nokia (Finland), Apple (US), Samsung Electronics (Korea) and Ericsson (Sweden) heavily contribute to standards development while at the same time own large patent portfolios some of which are declared as standard essential.

Also, many of the telecommunications carrier companies can be found in the list of top patent owners and standards developers, such as Verizon (US), AT&T (US), China Mobile (China), Deutsche Telekom (Germany) and Orange (France).

Table 1: Number of patents filed (pending and granted), number of SEP families declared and number of standards contributions that describe edge computing technologies, by current assignee/standards developer (IPlytics Platform, April 2021)

Current assignee/standards developer |

Patent filings |

SEP declaration |

Standards contributions |

Huawei (CN) |

821 |

138 |

862 |

Intel (US) |

686 |

42 |

488 |

Nokia (FN) |

576 |

87 |

439 |

SAS Institute (US) |

426 |

0 |

0 |

Apple (US) |

386 |

72 |

41 |

Samsung Electronics (KR) |

287 |

16 |

536 |

Verizon (US) |

196 |

0 |

50 |

Microsoft (US) |

188 |

0 |

0 |

Cisco (US) |

168 |

0 |

39 |

Ericsson (SE) |

163 |

6 |

374 |

LG Electronics (KR) |

160 |

33 |

144 |

NEC (JP) |

158 |

3 |

55 |

Pure Storage (US) |

155 |

0 |

0 |

IBM (US) |

125 |

0 |

0 |

Siemens (DE) |

120 |

0 |

30 |

Sony (JP) |

119 |

0 |

66 |

AT&T (US) |

99 |

0 |

130 |

ZTE (CN) |

96 |

4 |

193 |

Qualcomm (US) |

68 |

6 |

256 |

Tencent (CN) |

64 |

0 |

117 |

Convida Wireless (US) |

60 |

0 |

88 |

CATT Datang Mobile (CN) |

55 |

2 |

0 |

China Mobile (CN) |

54 |

0 |

206 |

Deutsche Telekom (DE) |

47 |

0 |

64 |

InterDigital (US) |

46 |

2 |

77 |

SoftBank (JP) |

46 |

0 |

4 |

Orange (FR) |

41 |

0 |

60 |

Hewlett Packard Enterprise (US) |

39 |

0 |

19 |

ETRI (KR) |

37 |

1 |

29 |

Fraunhofer (DE) |

35 |

11 |

17 |

Robert Bosch (DE) |

34 |

0 |

10 |

Sharp (JP) |

30 |

2 |

0 |

On the edge

The success of edge computing depends on the technology leaders listed in Table 1 that will develop devices, chips, networks, applications, services, sensors, and connectivity standards to realise the first edge computing use cases. It is predicted that the global edge computing cloud market will grow to $12 billion in 2021, which equates to an average annual growth rate of around 35%.

The expansion in 2021 will primarily be driven by telecommunications companies that use intelligent edge computing for 5G networks, as well as by hyperscale cloud providers that are optimising their infrastructure and service offerings. These market leaders have the necessary resources to establish use cases and best practices that will make it easier for companies in various industries to also use the enormous possibilities of intelligent edge computing in the near future.

It is assumed that by 2023, around 70% of companies will be conducting some of their data processing using edge computing.

Connectivity will rely on stable, real-time communication that allows the constant exchange of massive amounts of data. Tech standards will be fundamental to this, as they specify a common language so that different technologies and their components can interact. While patents are intended to provide incentives for R&D investment, standards serve as a common platform for innovative products to function.

Patenting and standardisation thus promote innovation jointly but in very different ways. Market leaders in the telecoms industry strategically align standards development with R&D efforts, patent prosecution processes, portfolio development, patent licensing and patent transaction practices.

Here, engineers work very closely with standards developers to continuously submit the latest technical advances in contributions to the standard body working groups, such as 3GPP or IEEE (the Institute of Electrical and Electronics Engineers), and report back to internal patent boards on any invention worth patenting beforehand.

The early filing of provisional and priority applications allows standards developers to patent contributions before they are submitted. These contributions – when approved by the working group – are means to integrating SEPs into the final standards specification.

Many SEP owners feel that with connectivity applications of 5G, it is not feasible to discuss royalty terms with each licensor individually. There must be an aggregated solution, which could be a patent pool or another mechanism to combine licensing efforts. As the number of standards implementers will dramatically rise, one often-suggested solution is to group patents under a patent pool contract.

The goal of patent pools is to simplify licensing by providing a single contract across all patent owners. However, the success of a patent pool depends on the number and size of patent owners that join, as well as the licensees that take a licence.

Licensing fees for SEPs in mobile standards (i.e., 4G, 5G or Wi-Fi) can easily amount to hundreds of millions of dollars per year, and the integration of patented and standardised connectivity standards poses serious economic risks for implementers.

Future technologies that enable connectivity will increasingly rely on patented technology standards such as 4G, 5G, Wi-Fi and many more. Even if SEPs are licensed in, standards implementers should bear in mind the dynamic market of changing SEP ownership where patent assertion entities often acquire SEP portfolios to assert extensive royalty payments.

As the number of declared SEPs is constantly rising, IP professionals working for standards-implementing companies should consider royalty costs and appropriate security payments in advance.

While the telecoms industry and large SEP-owning companies are experts in standards development and worldwide SEP filing and licensing, other sectors such as auto, consumer electronics, industrial manufacturing, energy, medical-healthcare and many more have little knowledge of connectivity standards that are subject to SEPs.

IP professionals in these sectors will need to gain more expertise around patents and standards to understand that by making use of technology advances around connectivity such as edge computing, they will need to implement patented standards and thus at some point will have to pay royalties for SEPs.

Furthermore, standards development is not only about developing the core technology layer of communication but also about developing application layers to enable technologies such as edge computing. For example, the 5GAA (5G Automotive Association), a global cross-industry organisation, was created to connect the telecoms industry and vehicle manufacturers to develop end-to-end solutions for future mobility and transportation services making use of 5G.

In this regard, experts across all industries where connectivity matters will need to consider participation in standards consortia such as 3GPP, IEEE and others to have a seat at the table where future technology decisions are made.

Tim Pohlmann is CEO of IPlytics, an IP intelligence company, in Germany.