Senator Lindsey Graham expressed concerns over the Avanci 5G patent pool in a letter to the Department of Justice shortly after the platform was launched in July 2020, it emerged this week as part of a freedom of information request made by Managing IP last year.

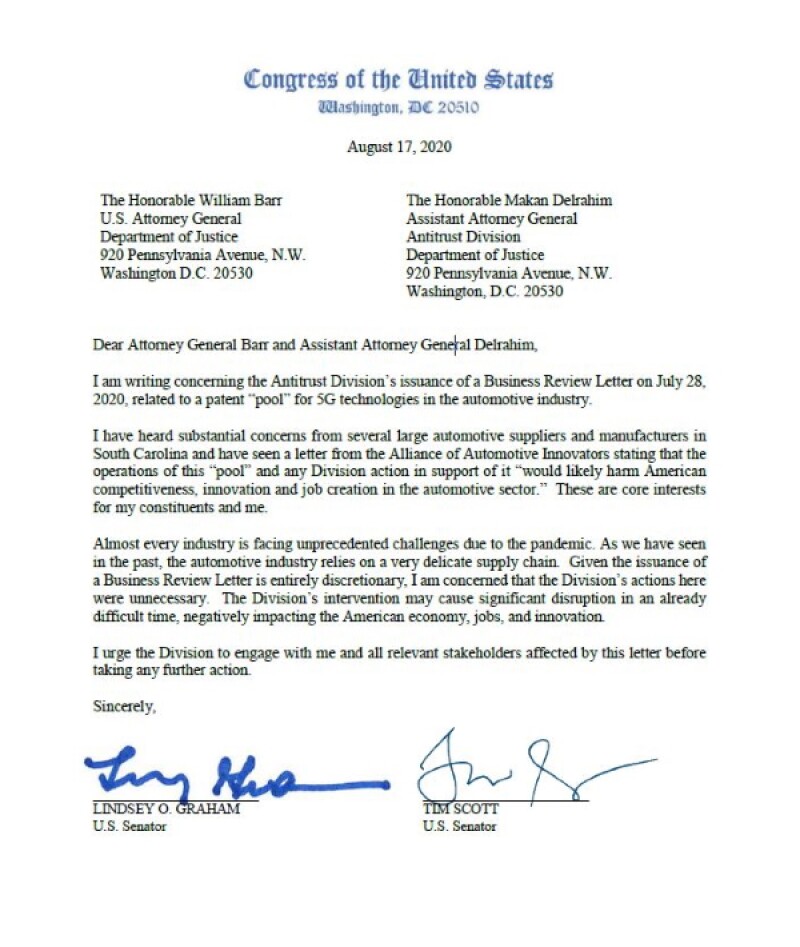

According to a letter sent to now-former attorney general William Barr and then-antitrust head Makan Delrahim, the now-ranking member of the Senate Judiciary Committee (and former committee chair) Graham said he was also concerned that the antitrust division’s actions “were unnecessary”.

“Given the issuance of a business review letter is entirely discretionary, I am concerned that the division’s actions here were unnecessary,” he said. “The division’s intervention may cause significant disruption in an already difficult time, negatively impacting the American economy, jobs, and innovation.”

Graham's letter was addressing the business review letter that the DoJ had published on July 28 2020 approving the Avanci 5G platform, a standard essential patent (SEP) licensing pool designed to bring together 5G patent owners and car makers. The pool was launched the day after, on July 29.

Related stories

The letter by Graham, sent a month later on August 17 and co-signed by fellow South Carolina senator Tim Scott, was issued in response to “substantial concerns from several large automotive suppliers and manufacturers in South Carolina”.

It cited a letter sent by the Alliance of Automotive Innovators on May 28, before the Avanci business review letter was issued, which said that DoJ support for the pool “would likely harm American competitiveness, innovation and job creation in the automotive sector”.

Graham's letter illustrates divisions between the top-ranking Republican in the judiciary committee, who has a big say on the development of intellectual property law in the Senate, and the former antitrust chief at the DoJ, Delrahim, on his IP and SEP policies as they affected the automotive industry.

The matter of SEP licensing between 4G and 5G patent owners and car makers, and the Avanci 5G patent pool by extension, is a controversial one. There are several cases ongoing in the US and in Europe over end-point versus component-level licensing in the industry.

In October 2020 Managing IP interviewed Delrahim (who stepped down in January), in which he said he was proud of the business review letters his department had issued, including those related to the Avanci 5G patent pool.