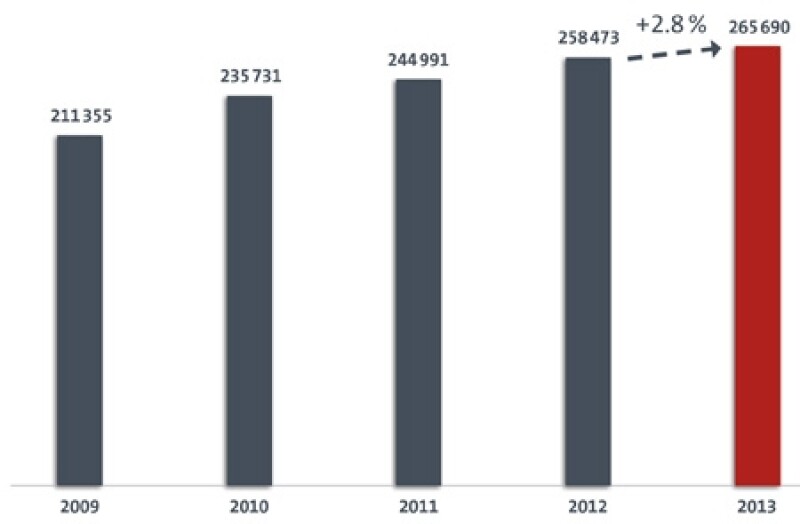

The EPO received 266,000 patent applications last year, up 2.8% on 2012. It granted 66, 700 European patents, which was 1.6% more than in 2012 and the highest number ever.

Applicants from the EPO’s 38 member states made up just over one-third of patent filers at the Office, a figure unchanged from last year. Of non-EPO country applicants, those from Asia continue to file growing numbers of applications. Those from China were up more than 16% and those from Korea up 14% on the year before.

The figures present a mixed picture for innovation within Europe. Of the big filing nations, applications from the Netherlands soared by 17%, with figures from Denmark up 7% and Sweden up 7.5%). From a rather smaller base, filings from Portugal and Turkey grew by around one-third, from the Czech Republic by one-quarter and from Ireland by almost 10%.

Filings from Belgium, Germany, the UK, Italy, Switzerland and Spain fell in 2013, however, with falls ranging from 7.4% (Belgium) to 1% (Spain).

With 2,883 applicants, Samsung easily beat its nearest patent filing rival (Siemens, with 1,974 applications) into second place. Philips, LG and BASF took the next three spots.

In nine of the 10 top technical fields, applicants from Europe filed the greatest numbers of applications with the EPO, which the Office said reflected Europe’s “balanced and wide-ranging patent portfolio”. European companies took over the top spot from US applicants in the field of medical technology, while the computing category was dominated by the US, which filed more than one-third of applications. Japan was strong in electrical machinery (with 25% of the EPO’s applications) and transport (22%), but China led in digital communication (15%).

The full data is contained in the EPO's Annual Report.