It’s a hot topic in the US in particular, where a series of executed and proposed so-called inversions designed to move the tax domicile of US companies to lower-tax jurisdictions has pushed tax policy up the political agenda.

The New York Times, for example, last week considered how pharmaceutical and biotech companies are increasingly transferring patent rights to subsidiaries abroad to enable them to enjoy lower rates of corporate tax. In Europe, the European Commission’s explanation on Tuesday of why it was taking on Ireland over its tax arrangements with Apple prompted US Senator Carl Levin, a long-time critic of multinational companies’ tax practices, to decry Apple’s practice of shifting some of its IP overseas.

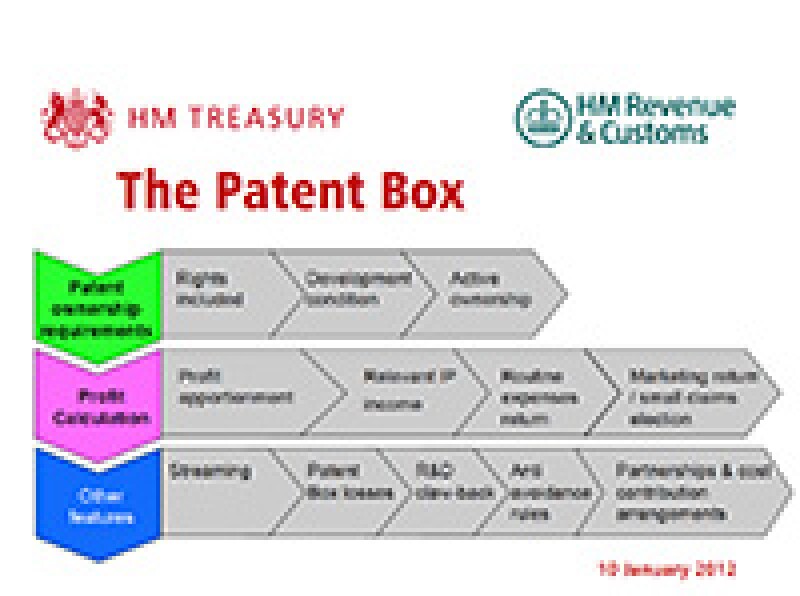

But patent boxes – which offer companies a lower rate of tax on that part of their income attributable to patents – have also come under scrutiny. Barrister and tax campaigner David Quentin and Nicholas Shaxson, the author of a book about tax havens, last week outlined their objection to the scheme in the UK.

They give three main reasons in support of their argument: first, that an 11% tax cut on the relevant income is unlikely to kickstart projects that would not otherwise get off the ground. Second, that the patent box rules do not simply reward the creation of new technology but also the owners of patents brought into the UK, as long as some work is done in the UK to exploit the IP. Third, that the patent system itself is designed to spur innovation, without additional subsidies.

The UK government’s real motivation in opening its own patent box, say the authors, was to compete more effectively in an international taxation race.

Evidence to support that view came last month from Germany, where Markus Kerber, the director of the Federation of German Industries, called on his own government to introduce a patent box to create meaningful incentives for keeping innovation and research and development in Germany.

There is limited data so far on the impact of the introduction of the UK’s patent box on the country’s rate of innovation. But we are interested in your experiences. Have the tax benefits on offer in those countries with a patent box changed the way your company treats IP? Have the incentives it offers been more than simply an opportunity for an accounting rejig? Do let us know.