Recently, the Korean medical devices market has been growing notably. According to a 2019 Annual Report by the Korea Medical Devices Industry Association, the Korean domestic market has grown at a CAGR (Compound Annual Growth Rate) of 8% during the last five years (2014 to 2018). The global medical devices market also exhibits a rising trend; Fortune Business Insight has forecasted a CAGR of 5.3% from 2018 to 2025. In view of a growing geriatric population, the prevalence of lifestyle-related diseases, and rising demand for new innovative devices and personalised healthcare services, the future medical devices market is expected to show steady growth.

In order to foster the domestic medical devices industry, the Korean government has recently introduced a new law, Development of the Medical Device Industry and Innovative Medical Device Support Act, effective from May 5, 2019. This new act is expected to further promote the development of new innovative technologies and the emergence of innovator companies in this field.

The recent statistical analysis of the Korean patent filings by the Korean Intellectual Property Office (KIPO) shows a similar trend. In the last 10 years (2009 to 2018), the number of patent filings in the field of medical devices has grown to 76,646 in total, with a steep growth rate, i.e. CAGR of 6.82%, which exceeds five times the growth rate (CAGR of 1.3%) of patent filings in the entire field.

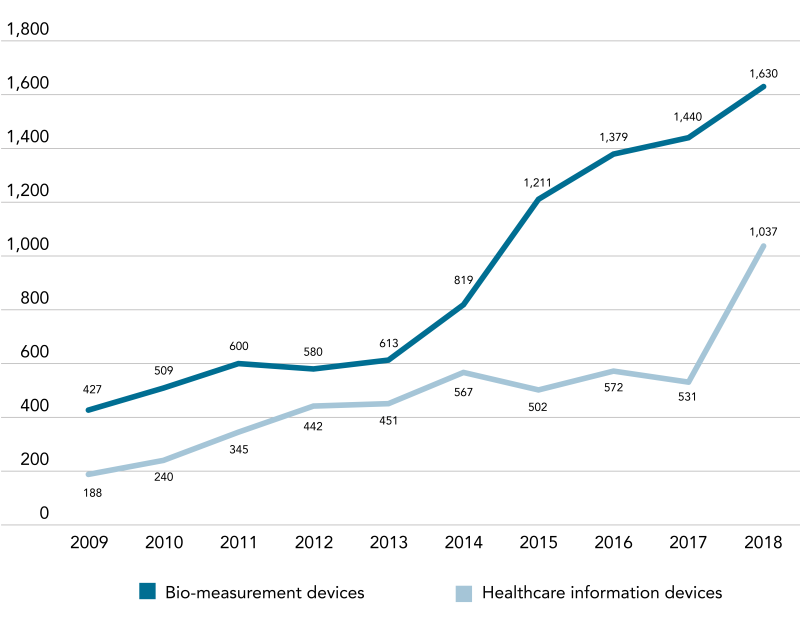

KIPO analysis indicates that there exists a large portion of patent applications directed to medical supplies, surgical/treatment instruments, and bio-measurement devices. The number of patent filings in the fields of healthcare information devices and bio-measurement devices has increased significantly.

According to the KIPO analysis, "healthcare information devices" are witnessing a boom due to the increased use of medical big data, the development of cloud-connected mobile healthcare platforms, and the emergence of AI-based medical services. In addition, "bio-measurement devices" are driven by the increasing demand for automated, miniaturised devices along with ICT-integration due to the transition of medical paradigm from treatment and care to prevention.

Domestic filers are very active, and Samsung Electronics and Samsung Medison ranked in the top two.

Needless to say, building a strategic patent portfolio is crucial to protecting a medical device company's core technology. In order to develop a strategic patent portfolio, it is necessary to include various claims covering the entire device or system, as well as key components, control systems, disposables, apps, methods of use, and any other valuable aspects of the invention.

In Korea, it is possible to use various claim formats; not only "a product" claim such as an equipment, system, apparatus, instrument, device, component, etc., but also a claim directed to "a method" of using or operating a medical device.

There is no particular restriction on pursuing a medical device itself, since a medical device for use in a surgery, treatment, or diagnosis method practised on a human being is patent-eligible in Korea.

Furthermore, a method of operating a medical device or a measurement method using a medical device is also patent-eligible, unless such method includes a substantial medical activity (i.e. a surgical, therapeutic, or diagnostic methods practised on a human body) or an interaction between the human body and the medical device, wherein the interaction has a direct and non-transient effect on the human body.

In addition, even a diagnostic method using a medical device can be protected, as long as it is clearly interpreted as a method for processing information on a computer, and a clinical judgment by a medical practitioner is not involved (e.g. a method for predicting cancer, comprising performing artificial intelligence algorithms in a medical device).

As additional strategies, utility model or design registrations can also provide protection for medical devices in Korea. Relatively speaking it is easier, quicker and less expensive to obtain a utility model or design registration than a patent. In order to provide a perfect protection barrier, it is advisable to consider various ways of protection for innovative medical devices.

Further, considering the tendency for medical devices to be commercialised much faster than other medical products, such as pharmaceutical products, it may be important to shorten the time to grant by using accelerated examination.

Korean patent trend in medical devices (2009-2018)

Domestic applicants (Top 5) |

Foreign applicants (Top 5) |

|

1 |

SAMSUNG ELECTRONICS CO., LTD |

KIMBERLY-CLARK WORLDWIDE, INC. |

2 |

SAMSUNG MEDISON CO.,LTD. |

UNI-CHARM CO., LTD. |

3 |

Industry-Academic Cooperation Foundation, Yonsei University |

SYNTHES GmbH |

4 |

Seoul National University R&DB Foundation |

SIEMENS AKTIENGESELLSCHAFT |

5 |

Korea University Research and Business Foundation |

F. HOFFMANN-LA ROCHE AG |

Min Son

Partner, Hanol IP & Law

HANOL Intellectual Property & Law

6th Floor, Daemyung Tower, 135, Beobwon-ro, Songpa-gu

Seoul, 05836

Republic of Korea

Tel: +82 2 942 1100

Fax: +82 2 942 2600