Biosimilar makers will increasingly use post-grant reviews (PGRs) – a type of proceeding available at the Patent Trial and Appeal Board (PTAB) – to cut down US patent thickets on biologics instead of inter partes reviews (IPRs), according to in-house counsel.

Sources at global pharmaceutical firms say explain that PGRs are better for challenging biologic registrations at the PTAB because biologic patents often have broad specifications that make them vulnerable to description attacks.

While both forms of post-grant proceeding have been recognised as cost-effective ways to invalidate patents compared to traditional litigation, PGRs can be used to launch written description attacks while IPRs can only be used to challenge patent prior art.

PGRs have yet to become a popular tool for biosimilar makers because they can only be used against patents with a priority date later than March 15 2013. But sources point out that the next wave of biologic patents coming to grant were filed after 2012 and have a later priority date.

“We have not filed any PGRs as of yet but will certainly be using them for future products,” says the global IP head at a pharmaceutical company. “PGRs will definitely be more popular, or at least as popular, as IPRs in the biosimilar space.”

The head of IP for biosimilars at an innovator drug company agrees, and adds that she has wanted to use this type of proceeding for a long time but could not because of the post-2012-filing start date.

She says that PGRs will be another useful tool for pharmaceutical companies to ensure freedom to operate for their biosimilar products, which is particularly challenging in the US where they are often blocked by enormous patent estates.

The planned worldwide launches of biosimilars for AbbVie’s blockbuster arthritis-treating drug Humira emphasises this difficulty. The drug was launched as a biosimilar in the EU in October 2018. A US version is not expected until 2023.

“Patent thickets are a problem in Europe but not as much as they are in the US,” says the biosimilar head of IP for an innovator firm. “These estates currently are not seen as anti-competitive and yet an originator could have five inventions and turn it into 50 patents just by filing 10 divisional patent applications for each invention.

“It is now just a numbers game and not a matter of IP quality.”

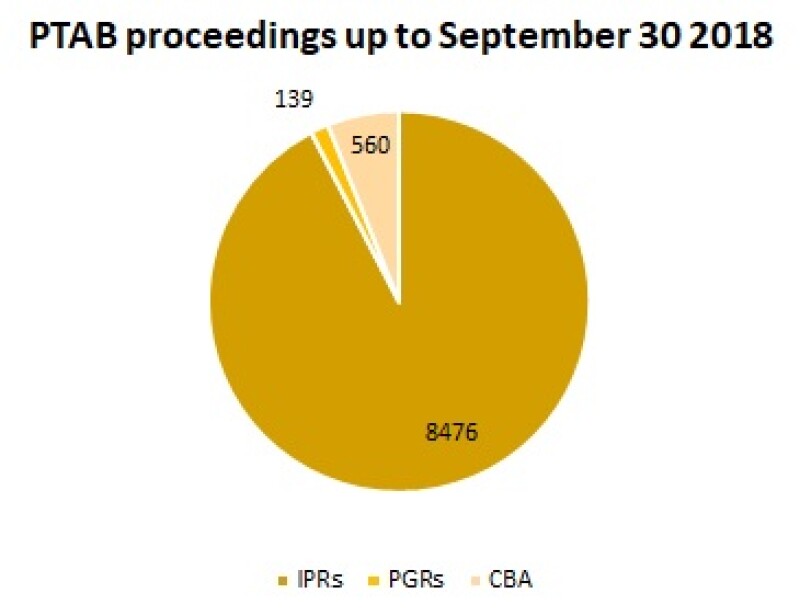

PGRs and IPRs were both introduced by the America Invents Act in 2012 – and so far the latter proceeding has been the most used across all industries at the PTAB. According to the USPTO, 8,476 proceedings out of 9,175 (92%) at the board between September 2012 and 2018 were IPRs. Only 139 (2%) were PGRs.

Covered business methods (CBMs), the only other form of post grant proceeding at the PTAB, were also more popular than PGRs – with 560 petitions.

IPR indicators

Sources say that they have largely relied on IPRs to attempt to cull biologic patent thickets at the PTAB, but that could change as PGRs become increasingly applicable to biosimilar strategies. After all, PGRs offer the same benefits as IPRs and more – which means drug companies’ enthusiasm for IPRs is a good indicator of PGR popularity potential.

The head of IP for biosimilars at a generics drug company says that, given the popularity of the IPR system in the biosimilar world, PGRs with their broader scope will quickly become very popular with drug companies.

“IPRs are very commonly used for biosimilars,” he says. “Just in my own portfolio here, I am defending against nine IPRs brought against my company’s patents, and my team has filed around 15 in the last couple of years as a means to clear the path for biosimilars.”

The deputy general counsel at an innovator drug firm adds that his company has also been attacked by multiple IPRs and he suspects that it will have to fend off biosimilar makers taking advantage of administrative challenges in the form of PGRs as well.

But there are two differences between IPRs and PGRs that might curb biosimilar makers’ enthusiasm for the latter.

A 2016 report from RPX Corporation suggested that an IPR could cost anything between $100,000 and $700,000. That figure would be higher now because the USPTO increased IPR fees by 33% and PGRs costs by 27% in 2018. Yet an IPR is still cheaper than a PGR.

The innovator firm’s biosimilar head of IP says that PGRs might cost her firm anything up from $1 million per patent, which is about 10 times more expensive than a standard opposition. But she adds that given the potential usefulness of the proceeding type, this cost may not significantly limit the number filed over the next few years.

The second factor is time. Unlike an IPR, a PGR must be filed against a patent within nine months of its grant, which would force biosimilar applicants mapping IP protection for a brand product to be more diligent in establishing an IP portfolio early on.

“This timing cut-off is one reason why PGRs may not reach the levels of popularity of IPRs,” says the generic firm’s biosimilar IP head. “It is questionable whether a biosimilar applicant is going to want to invest $1 million to $2 million attacking a patent many years ahead of its likely biosimilar launch date.”

The global IP head at a pharmaceutical company does not believe these factors will dramatically reduce future PGR popularity because of the importance of challenging patent thickets and reducing risk when it comes to freedom to operate.

He and the innovator firm’s biosimilar head of IP agree that global drug firms are likely to embrace the proceeding’s provisions because they are already used to the nine month cut off for European oppositions and they will lead to earlier patent clearing in the US, which benefits the biosimilar industry.

Better for innovators?

One may argue that the potential transition from IPRs to PGRs among biosimilar makers in the US is a good thing for biologic patent owners.

The deputy general counsel at an innovator drug firm says that IPRs are particularly frustrating because they undermine the litigation scheme set up by the Hatch-Waxman Act and can be used to challenge a patent at any time.

He says that innovators want a front-end quality for their patents, which is established by a quality examination and, more importantly, an early challenge.

“I do not mind PGRs as much as IPRs because we are used to the European opposition system and the idea that companies can try to attack patents within nine months of grant.

“Nine months is also early in the drug development process, which is good for us. It is after you have invested millions of dollars and developed the market that a patent attack really injures you.

“On the other hand, I cannot tell management that they have a predictable patent if at any given time they can face challenge after challenge from IPRs.”

He adds that his company and others like it are advocating for the PTAB to use its considerable discretion when considering whether to accept an IPR petition, and for it to consider that there may be better ways to administer justice than serial of parallel cases against a patent.

US biosimilar makers are ready to embrace PGRs to better pave the way for their lucrative biosimilar products. The next wave of biologic patents will be a good test for their enthusiasm – but perhaps not even high costs or efficient planning will stop them.